PCCA Journal|1

st

Quarter 2015

16

6UJMJUZ 0VUMPPL

Continued from page 14

Communication

Spending Forecast

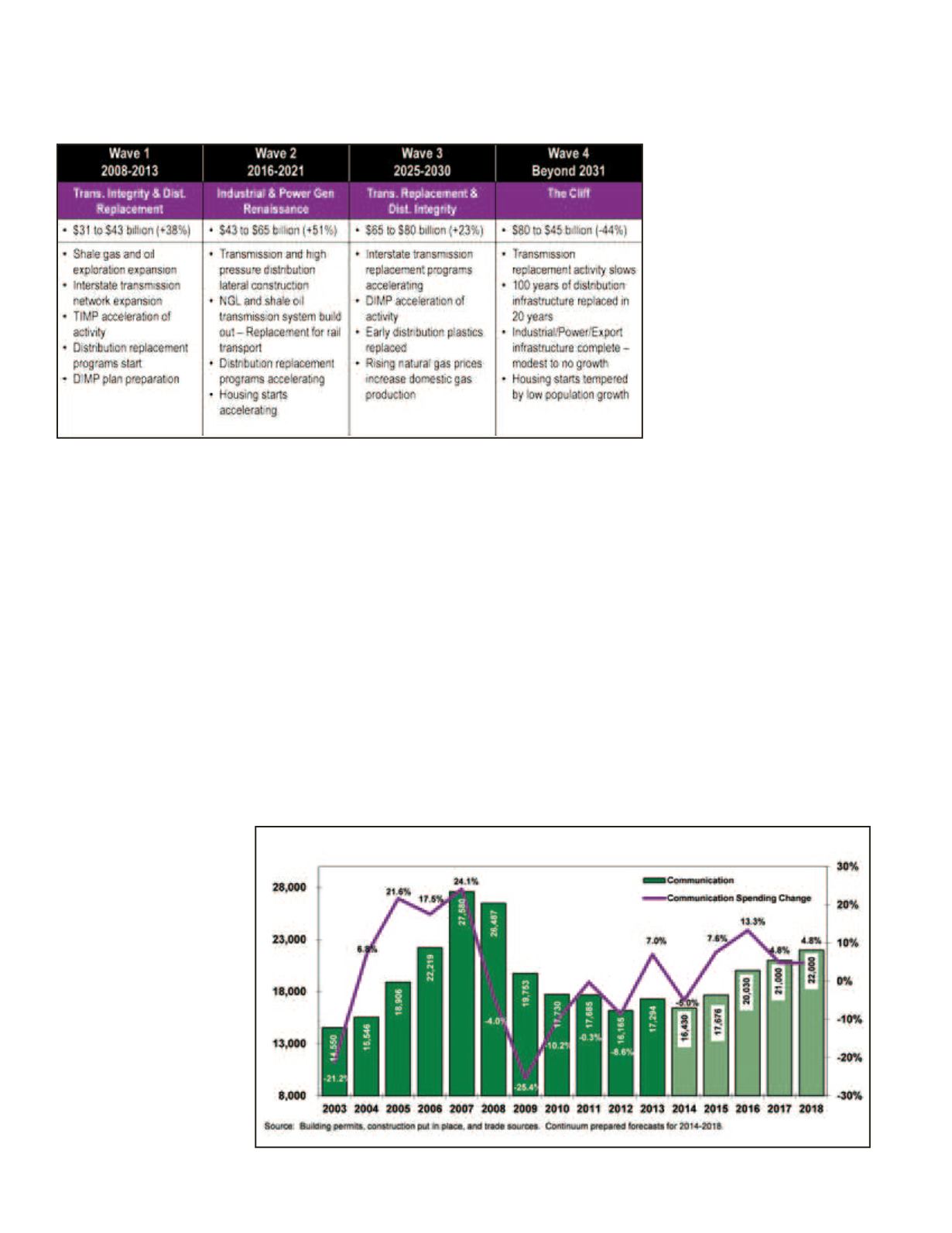

The dominant trend in communication spending, as always,

is volatility...the trough in 2003, the peak in 2007, the trough

in 2012. We enjoyed a mini spike in spending in 2013, and we

are now forecasting growth in spending that is accelerating in

2015 and 2016. The growth in these years is driven by a single

factor: competition between Google, AT&T, Verizon, and Cen-

turyLink among others to bring fiber and high-speed service

to major cities in the United States. This competition is the

sole driver of growth in 2015 and 2016, while the underlying

growth rate in spending is below 3 percent. We also anticipate

this competition to conclude by 2017, reducing the spend-

ing growth rate. Beyond 2018, we anticipate faster spending

growth associated with the still undefined 5G technology as

well as faster U.S. economy and housing growth that will ap-

proach a cyclical peak around

2020 (Exhibit 7).

Communication

Trends

The build-out of the 4G

infrastructure is nearly

complete nationwide and

the underlying short-term

future for spending growth

is related to incremental

improvements in capacity.

The rejection of the Sprint/T-

Mobile merger signals an end

to industry consolidation. This

lull in typical activity will not last

if Google is effective at sparking

competition for faster internet

connections. Google is currently

rolling out Google Fiber in Kansas

City, Austin, and Provo. As of

January, a second wave of cities

were selected, including Atlanta,

Charlotte, Nashville, and Raleigh-

Durham. The company has further

indicated plans to expand into

additional cities. Jason Armstrong,

an analyst with Goldman Sachs,

estimated that the company could

spend approximately $1.25 billion

annually to connect 7.5 million

homes through 2022.

7

Google Fiber is not really an effort to become a major

player in the Internet Service Provider market, but more of

an effort to create competition among traditional broadband

providers including AT&T, Verizon, and CenturyLink to offer

faster service.

8

The growth we are forecasting in 2015 and

2016 is solely related to Google spending on its fiber program

in conjunction with some spending by traditional ISPs in

response to the competition.

Beyond 2016, the underlying growth is driven by data

management. The Telecommunications Industry Association

stated:

“Big data is driving the accelerating investment in the U.S.

market. Growing consumer demand for data led to a double-

digit increase in spending on wireless telecommunications

Exhibit 6

Exhibit 7