PCCA Journal|1

st

Quarter 2015

13

A future vision of what this widespread replacement of

distribution infrastructure might look like can be found in

Indiana and Virginia. Indiana’s Senate Enrolled Act 560 will

drive billions in spending on new transmission and distribu-

tion lines, new substations, upgrades to existing lines and

substations, and replacement of aging poles, transformers,

line equipment and other infrastructure. The wording of a

portion of the legislation reads, “...the utility may then adjust

rates every 6 months, subject to Indiana Utility Regulatory

Commission and Indiana Office of Utility Consumer Coun-

selor review, to recover 80 percent of the project costs as they

are incurred. The remaining 20 percent must be deferred un-

til the utility’s next base rate case, which must be filed before

the end of the seven-year period. The rate increases—under a

new Transmission, Distribution, and Storage System Improve-

ment Charge mechanism—may not exceed two percent of the

utility’s total annual retail revenues.”

2

In the case of Virginia,

state legislation requiring the undergrounding of at-risk elec-

tric distribution and transmission infrastructure could result

in $10 billion in spending over the long-term.

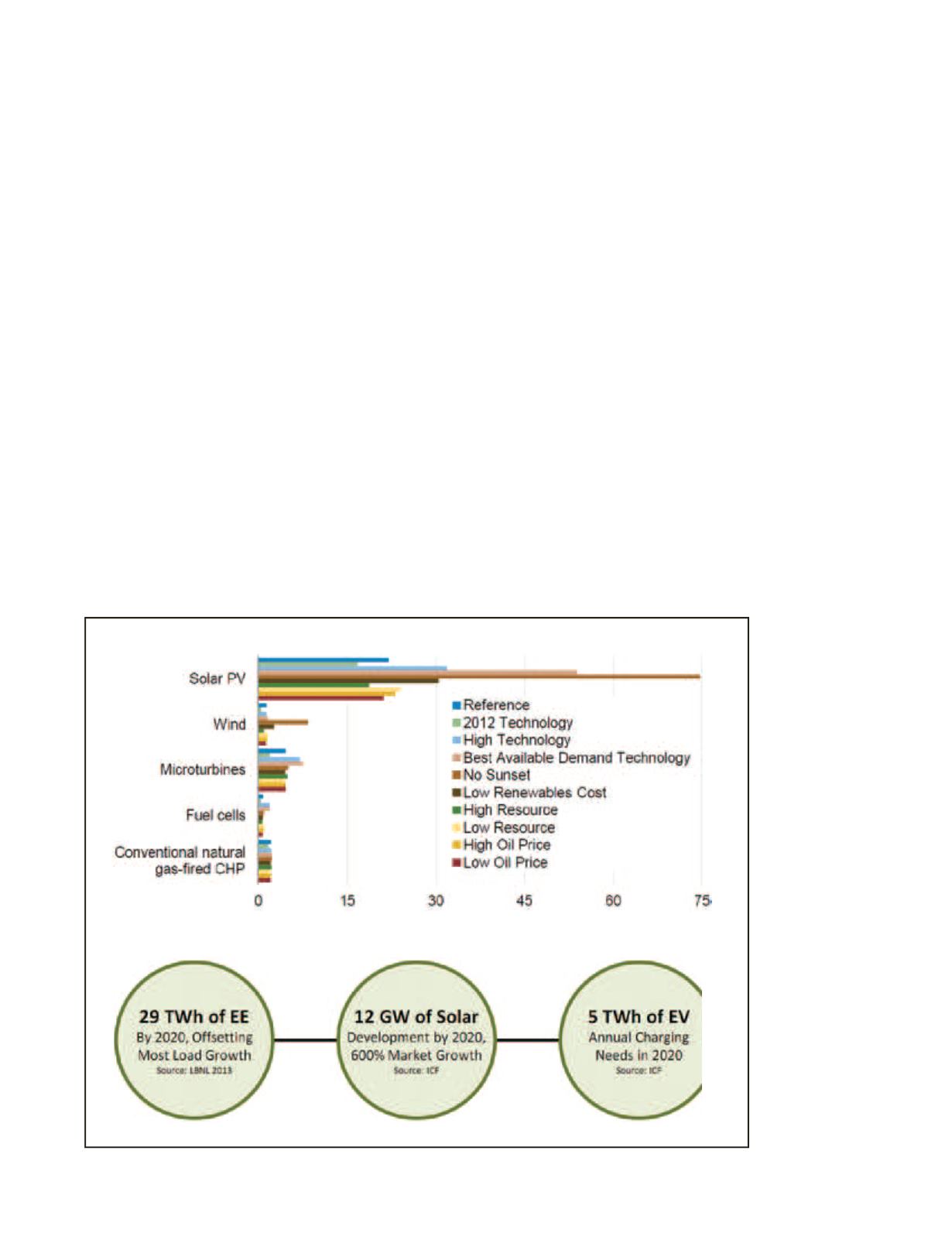

In Exhibit 4, an Energy Information Administration study

describes the range of possible outcomes for distributed solar

generation on buildings alone as significant with anywhere

from 17 to 75 gigawatts of generation potential.

3

Another

view from ICF International in Exhibit 5 forecasts significant

distributed energy resources by 2020 driving down the need

for traditional generation capacity.

4

As a frame of reference,

U.S. electricity consumption in 2012 was 4,069 terawatt

hours

5

, and the typical U.S. home consumes 10,837 kilowatt

hours of electricity annually.

6

The addition of other forms of

distributed generation and energy efficiency will further drive

disruption.

The communication industry may predict the path of

the electric market. Beginning with the breakup of the Bell

system in 1982, the industry experienced 30 years of rapid

change involving technology, ownership structure, and cus-

tomer demands. Organizations that were not nimble simply

do not exist anymore. This fact should serve as a warning to

electric utilities that are just beginning a period of fundamen-

tal change and disruption.

Gas and Liquid Transmission & Distribution

Pipeline spending remains on a tear. The primary driver is re-

placement activity in the first half of our forecast period and

subsequently by an industrial and power generation renais-

sance that will result

in the strengthening

of systems across

the country, par-

ticularly in regions

where shale oil and

gas are located. We

have received many

questions about the

falling price of oil; it

will have an impact,

just not the one envi-

sioned. (See “Falling

Oil Price Impact on

Utility Construction”

on page 14.) This

activity will also

include new trans-

mission and high

pressure distribution

spurs. The long-

term prospects and

spending rational are

detailed in Exhibit 6.

Continued on page 14

Exhibit 4

Exhibit 5