PCCA Journal|1

st

Quarter 2015

14

6UJMJUZ 0VUMPPL

Continued from page 13

T

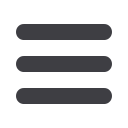

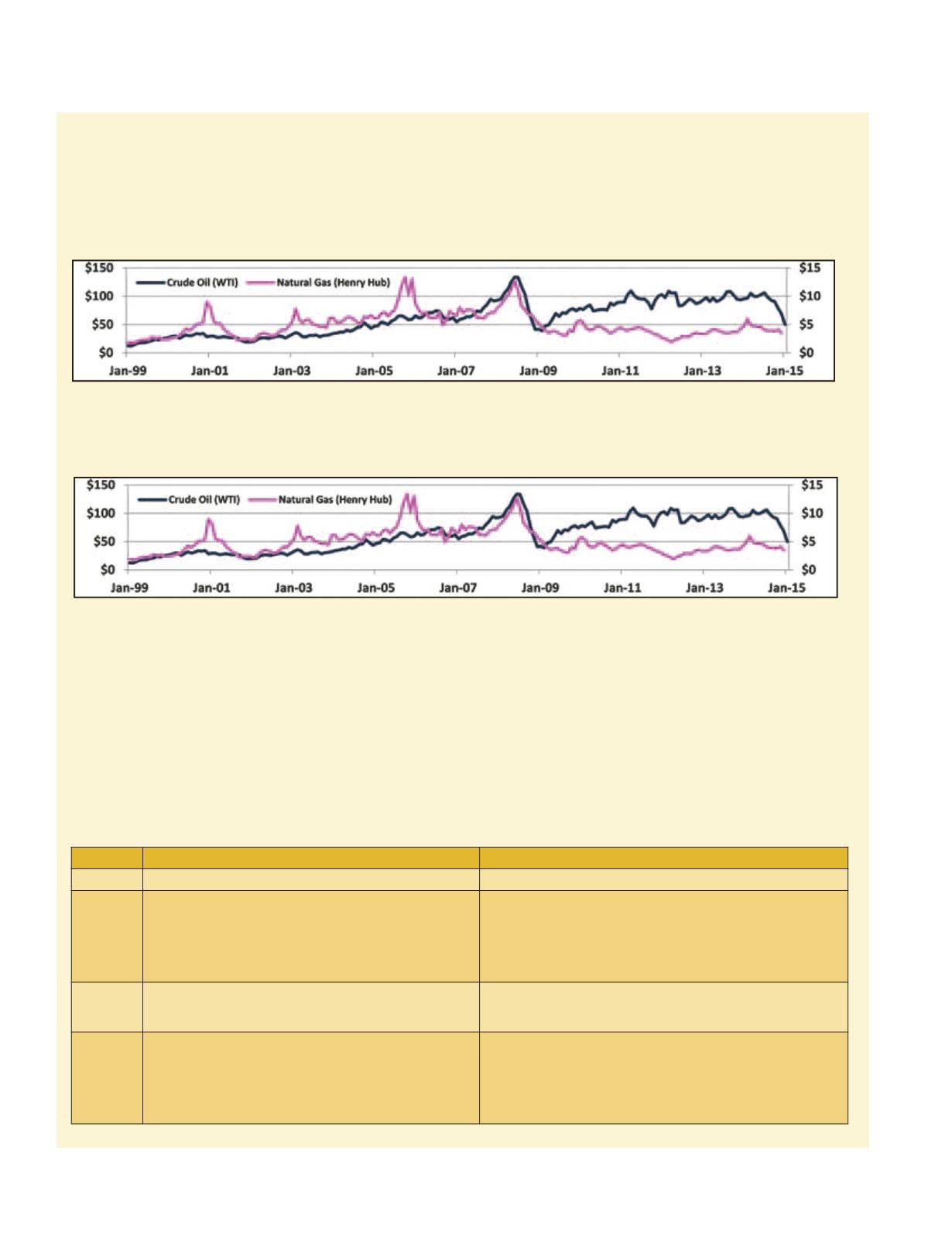

he freefalling oil price caught many observers off guard. Historically, crude oil and natural gas prices have tended to

stay in alignment as the imbedded energy content is the defining characteristic. Since 2010, when the pricing of these

commodities separated, many observers have anticipated upward volatility in the price of gas to realign it with the

price of oil. Few analysts anticipated oil falling to realign with low-cost natural gas.

Falling oil prices impact the competitiveness of U.S. shale oil plays. Example basin breakeven extraction costs demonstrate low

competitiveness in the $40-$60 range. While the reasons for the freefall in crude oil are highly complex and frankly not cur-

rently well explained, there is no doubt that it is creating both positive and negative implications.

Drivers for the falling oil price include the following:

s

Low Global Demand: The economic slowdown in Asia and Europe has reduced demand.

s

High Supply: Five years of $90+ oil led to massive investment in exploration and production.

s

OPEC Weakness: OPEC’s share of world supply is declining, members have grown fat domestic budgets fueled by high-priced

oil, and these countries want to protect their market share.Geo-Political Action: Saudi Arabian opportunity to economically

punish Russia, Iran, and Syria without directly harming the U.S. and inflicting moderate and manageable damage to their

domestic budget.

s

Speculation: It is not clear what role speculators play in the current crude oil price swing, yet there is general agreement that

speculative activity continues and is moving prices.

Impacts to shale oil and gas markets along with underground and pipeline contractors include the following:

Falling Oil Price Impact on Utility Construction

Market

Most Likely Outcome

Severe Outcome

18 or Less Month Price Down Cycle

3+Year Price Down Cycle

Shale Oil

Price #oor $45; recovery to $80-$90 in 2016

Exploration slows; Production #attens

Exploration spending falls modestly

Liquid pipeline construction #attens and is focused on reducing rail tra%c

Overall economic impact positive; +1% to GDP

Price falls below $40 and remains below $60

Exploration stops; Production #attens then falls

Exploration spending collapses

Liquid pipeline construction spending collapses

Overall economic impact uncertain to negative

E&P defaults damage capital markets

Shale Gas

Shale gas price remains stable/low

Rigs move back to wet gas basins

Capital spending is constrained

Same as above

Industrial and transportation use #attens

Collapse pushes natural gas price down

Contractors

Activity remains replacement and system capacity related

Flat transmission market for 2015 & 2016

Limited delay of new large pipeline projects

Reduced wage pressure

Distribution market remains strong with lower growth rate

Liquid market reduced to integrity work only

Gathering contractors enter and disrupt distribution market

Rate payer impact hurts distribution spend

Postponed distribution spend stresses existing system T&D capacity

Loss of workforce limiting growth post-2018

Constrained capital for high risk energy market

Continued on page 16