PCCA Journal|1

st

Quarter 2010

14

sions there dropped 50 percent, and by 2007 they had

essentially ended.

11

Over the long-term, FMI expects growth in the

construction of gathering lines to be directly related to

the upstream gas sourcing and drilling efforts. More

stringent environmental and permitting requirements

will slow or lengthen this effort. According to Neil

Ellerbrook, chairman and CEO of Vectren Corp., “Our

industry will probably see more regulation, especially

in the area of access to new natural gas supply. On

the other hand, given the fact that our customers have

been leaders in energy efficiency and conservation for

the past 40 years, we are well positioned....”

12

Gas Transmission

Transmission and large-

diameter pipe will see 6 to

10 percent growth, particu-

larly to support the natural

gas fired power generation

market. As of fall 2009, 74

natural gas-fired generation

projects valued at more than

$20 billion were scheduled for

construction kickoff during

2010 alone.

13

Many of these

will require significant pipe-

line construction to supply the

facility with fuel.

Much of the current spend-

ing for 2010 is carry-over proj-

ects begun in previous years.

According to Jeff Wright,

director of energy projects

for FERC, 2009 had 172 miles of transmission

pipe approved for construction and was a slow

year compared to 2008, in which 2,140 miles

were approved. Many of the larger projects that

fall under FERC jurisdiction follow multi-year

timelines, and therefore construction activity

cannot always be directly tied to permitting.

Wright said the recent decline is likely a result

of the market catching up from the blazing rate

of permitting, approval, and construction activ-

ity over the past few years, and he is optimistic

that 2010 will be much stronger. There are cur-

rently 2,600 miles of pipeline under review or

in pre-filing stages.

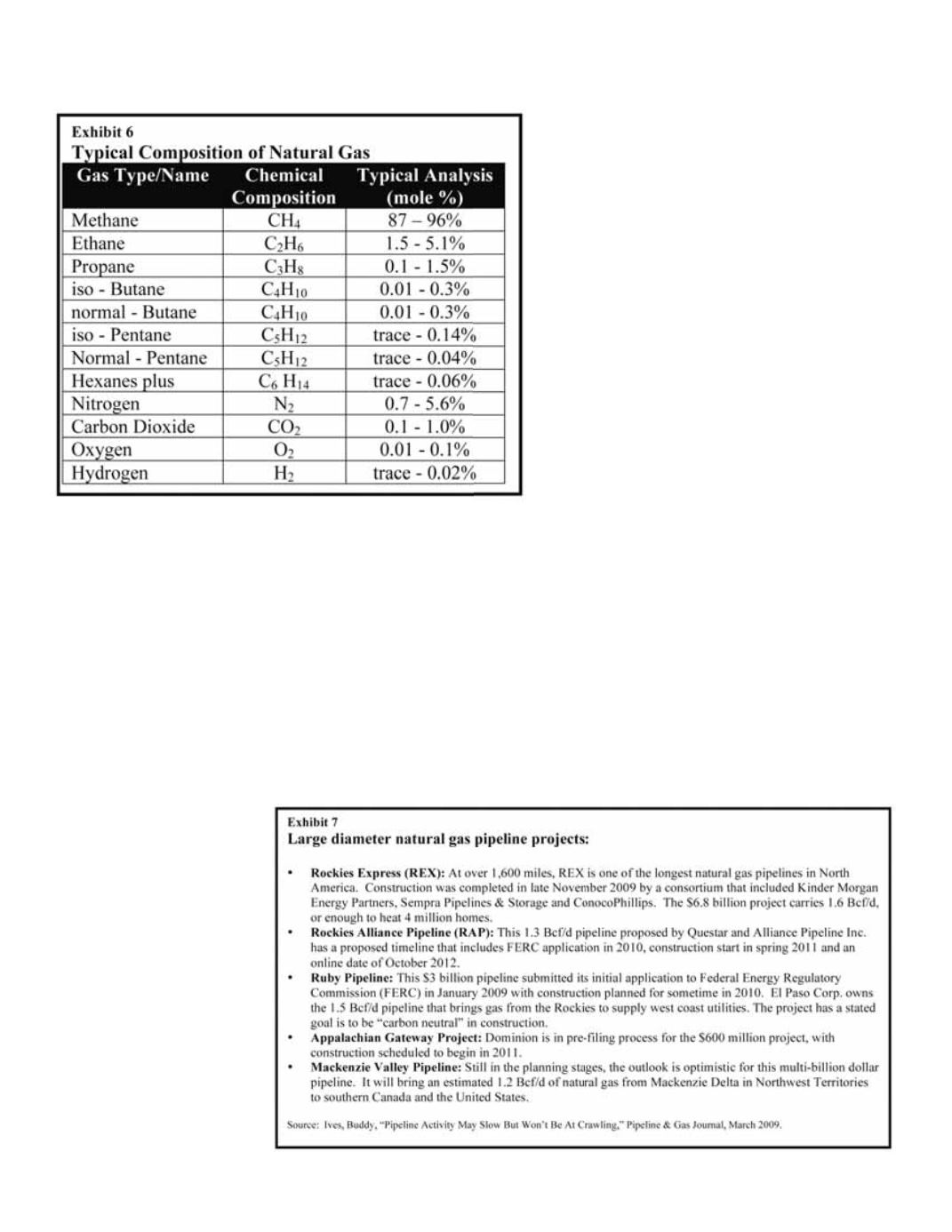

Rock-bottom natural gas prices and expand-

ing domestic supply result in varied construc-

tion activity. Though extraction activity has

slowed as the natural gas price has fallen,

pipelines are still being constructed to support

additional generation capacity from a cheap,

relatively clean fuel source. The various forms

of natural gas have very few or only one carbon

atom, making it the cleanest fossil fuel in terms of

carbon emissions (Exhibit 6). More than 17,000 of the

27,000 miles of pipeline planned or under construc-

tion before 2012 will transport natural gas.

14

Domestic

pipeline construction is driven by low commodity

prices, which slow some distribution construction but

accelerate gas use in power generation. Many 2009

projects, however, have been pushed to 2010 due to the

economic downturn, declining energy demand, and

financial constraints (Exhibit 7). Case in point, U.S.

crude oil production for the month of October 2009

averaged 5.36 million barrels per day, a five-year low

last seen in 2005.

15

Pipeline owners and operators are particularly wary

of the federal government’s more widespread regula-

Market Forecast

Continued from page 13