PCCA Journal|1

st

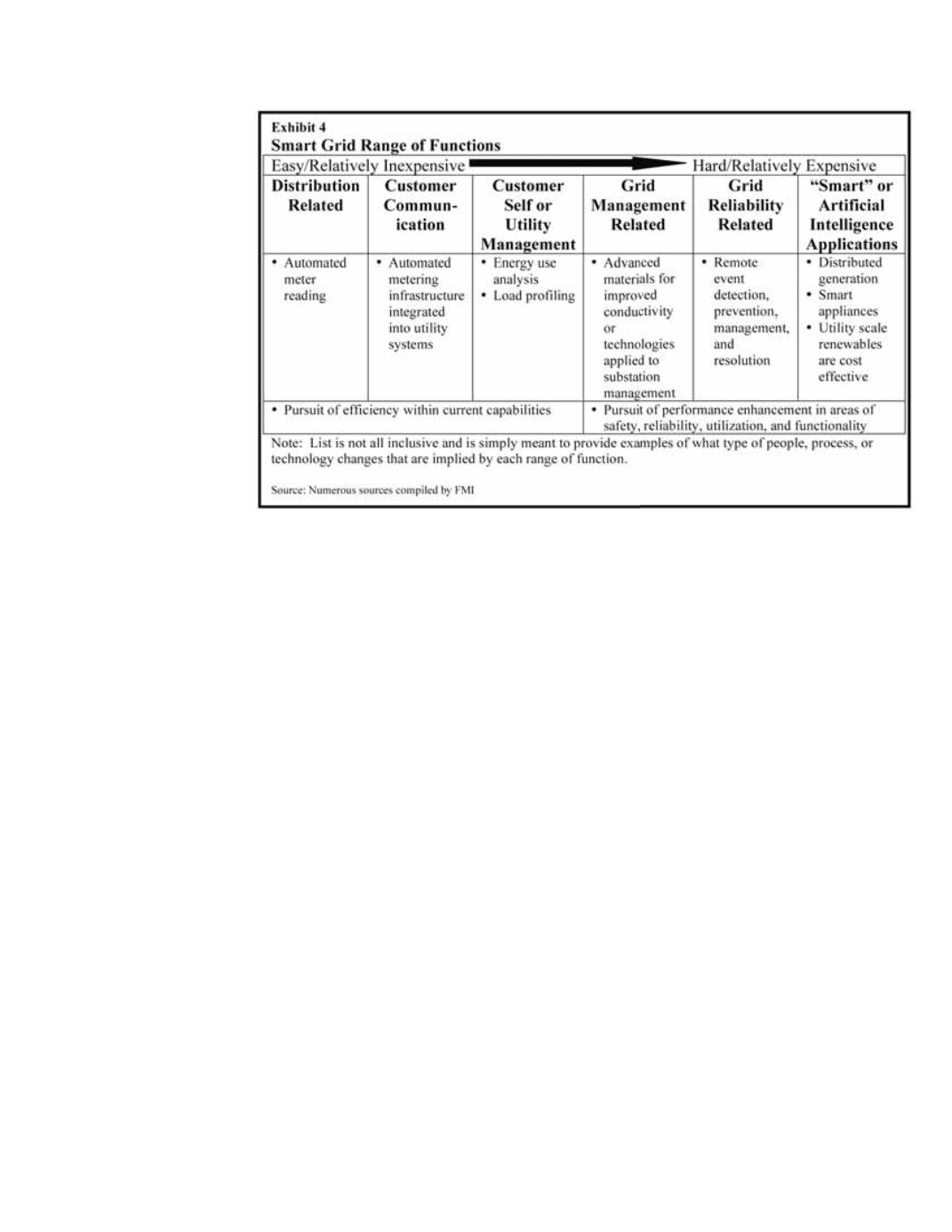

Quarter 2010

10

Smart Grid Impact

In the utility world today,

few topics are as hot, yet

as confusing, as the smart

grid. With companies

like Cisco predicting the

underlying communica-

tions network will be “100

or 1,000 times larger than

the internet,” there is

good reason to be excited.

1

Experiments in converting

cities over to a “smart grid”

are well under way, with

Boulder, Colo., and Austin,

Tex., leading the way.

In Boulder, Xcel Energy

invested $100 million to

build one version of a

smart grid. All in, Xcel

installed 200 miles of fiber

optic cable, 4,600 residen-

tial and small business

transformers, and more than 16,000 smart meters. The

project has been a success. Customer complaints about

voltage fluctuation were reduced to zero from 60 a

couple years earlier.

2

Xcel’s work in Boulder is one example of a smart

grid, but how else might the concept be applied and

how will it impact construction spending? While there

is no consistently accepted definition, a smart grid

generally consists of a spectrum of opportunities, some

of which are already in high use (Exhibit 4). It is FMI’s

opinion that the impacts to both distribution and trans-

mission construction activity are years away with the

exception of meter replacement, which is accelerating.

With the grid approaching capacity and more power

set to come online, the Department of Energy’s (DOE)

Office of Electricity Delivery and Energy Reliability has

partnered with industry to begin shoring up transmis-

sion lines using high-temperature superconducting

(HTS) cables. The first such project was completed in

April 2008 when the American Superconductor Cor-

poration and Long Island Power Authority energized a

2,000-ft., 138-kV cable capable of transmitting 574MW

of energy. The project cost $58.5 million and would

not be possible without a $28.5 million subsidy by the

DOE.

Also underway is a $39 million project on New York

City’s network, operated by ConEdison. Dubbed “HY-

DRA,” the project is dependent on the Department of

Homeland Security for $25 million in funding.

3

As NRG

Energy CEO David Crane explained, “If we are not do-

ing things completely differently by 2030, we will be in

a world of hurt....”

4

The ARRA, better known as the stimulus program,

appropriated $6 billion to support the DOE’s loan guar-

antees of $60 billion for renewable energy and electric

transmission projects. While undoubtedly a noteworthy

and positive measure, utilities and transmission devel-

opers are having trouble obtaining permit approval to

site and build transmission lines. Standing in their way

is a maze of both state and federal regulations, with

the two sets often misaligned.

In California, a state known for its progressive stance

on regulating transmission construction, Governor

Schwarzenegger announced he would veto legislation

requiring 33 percent of the state’s energy to come from

renewable sources by 2020, instead choosing to man-

date the change through executive order. His action is

out of concern for what his communication director

called a “poorly drafted, overly complex bill...that will

kill the solar industry in California and drive prices up

like the failed energy deregulation of the late 1990s.”

5

The source of the conflict was a provision that allowed

California utilities to buy power from outside the state.

Renewable Power Impact

“The United States...lacks a modern interstate trans-

mission grid to deliver carbon-free electricity to cus-

tomers in highly populated areas of the country...’Green

power superhighways’...carrying electricity from remote

to populated areas...the key to any cost-effective plan

is the use of high-voltage transmission lines in place of

the low-voltage lines commonly deployed in the U.S.

Market Forecast

Continued from page 8

Continued on page 12