PCCA Journal|1

st

Quarter 2010

12

today.”

6

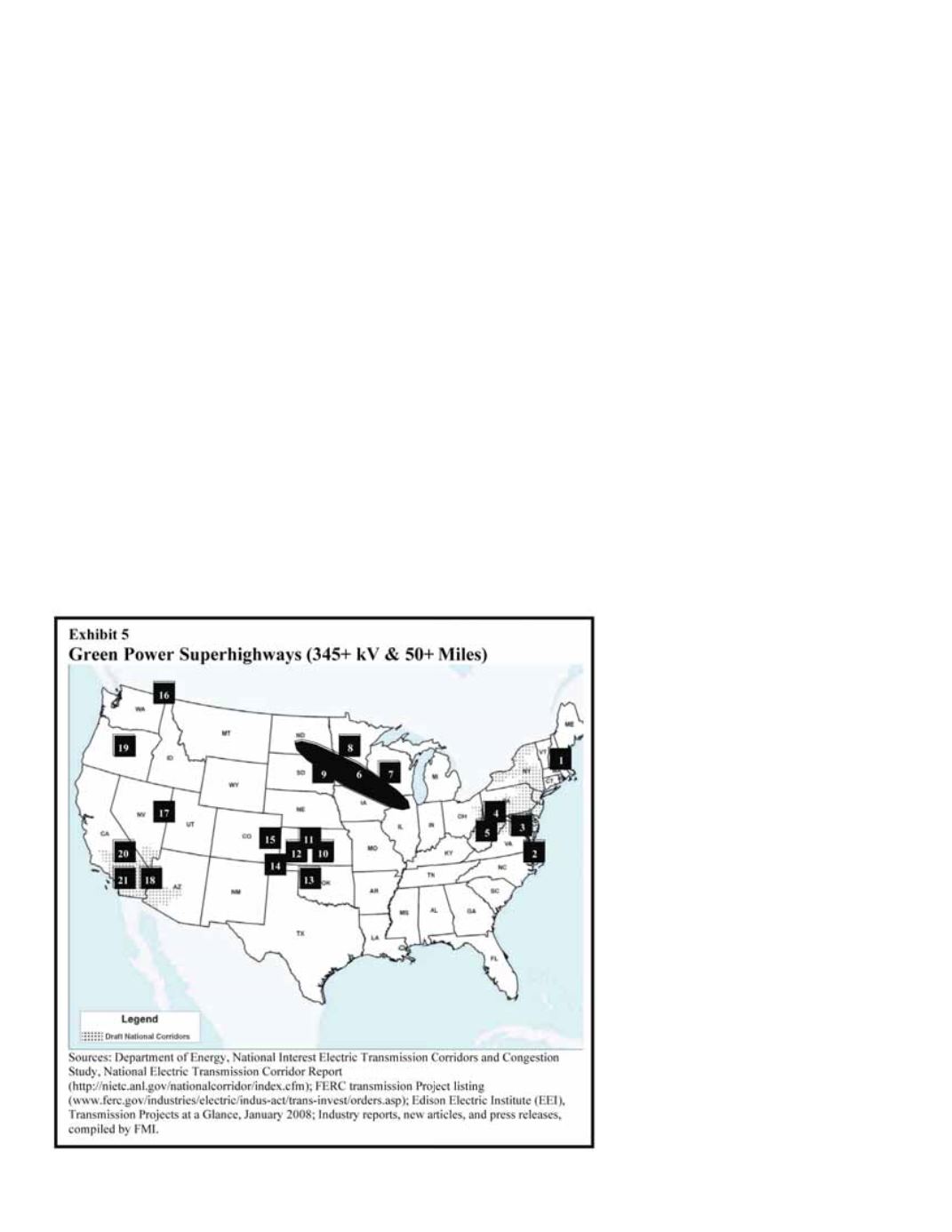

Green transmission corridors, particularly those in

support of wind energy, are already a significant driver

of transmission construction across the U.S. and at the

same time address reliability and aging infrastructure

concerns. A number of transmission congestion studies

and work by the Federal Energy Regulatory Commis-

sion (FERC) resulted in the start of a process to acceler-

ate transmission grid infrastructure build out. Exhibit

5 identifies 21 areas where major (over 345-kV and

more than 50 miles long) transmission lines have been

proposed, planned, or are under construction. These

projects range in cost from hundreds of millions to

billions of dollars and represent a large chunk of total

U.S. transmission spending between 2010 and 2014.

The wind power market accounted for 42 percent of

new electricity generation in 2008 with roughly 8,500

MW brought online.

7

While the 2009 numbers had not

been released at the time of publishing, the year is

likely to finish with somewhere in the neighborhood

of 7,000 MW being added. Wind energy is the fast-

est growing, most significant, and therefore the most

relevant of renewable energy sources today. Given the

incentives incorporated into the ARRA, FMI expects it

will continue to thrive. Texas remains the clear leader

in wind power generation with over 8,700 MW in-

stalled, although Pennsylvania and Wyoming both saw

more growth during 2009. Visibility has raised compe-

tition dramatically in this segment for designers and

contractors who have operated in it for years.

Looking forward to 2010, many analysts predict a

banner year for wind farm construction as the legisla-

tive environment appears to be moving in favor of

renewable energy. While FMI is in agreement that 2010

through 2012 will likely be some of the strongest years

on record for domestic wind energy construction, we

are also mindful of tight credit markets, utility power

purchase agreements demand, and an investor commu-

nity reluctant to fund riskier renewable energy projects.

Nearly everyone is optimistic on wind power construc-

tion, but a soon-to-be-released report from Ion Con-

sulting of Denver, Colo., is much more pessimistic. In

“Near-Term Outlook for U.S. Wind Market Sector,” Ion

cited four drivers that will significantly constrain wind

power construction:

Ignorance of the role a utility has in determining the

1.

demand for new wind additions

The bubble of merchant wind projects where a util-

2.

ity was signing their very first PPA

Lower demand for power that will likely defer 4,500

3.

MW of new renewables

Financial market constraints that will likely con-

4.

Market Forecast

Continued from page 10

tinue through 2011

While FMI is not nearly as pessi-

mistic, we see significant challenges

beyond 2012 when domestic wind

power growth will likely slow signifi-

cantly as the industry faces severe

interconnection and transmission

infrastructure challenges.

Gas and Liquid

Transmission & Distribution

FMI forecasts positive but unbal-

anced growth for gas pipeline

construction in 2010 forward. New

service construction is essentially

nonexistent, while higher-pressure

distribution and pipeline replace-

ment work are exhibiting significant

growth. Also affecting gas T&D

is the uncertainty around emis-

sion standards, which continue to

discourage the development of new

coal-fired assets, and with nuclear

power still five to seven years off,

gas-fired capacity will be a vital part

of base load generation construction

going forward. Overall, FMI forecasts

3 to 5 percent annual growth for the