PCCA Journal|1

st

Quarter 2010

18

will not occur without governmental impact, however,

as stimulus packages bolster Asian-Pacific communica-

tions firms thereby increasing their ability to compete

in North America. Exhibit 9 illustrates the United

States’ lackluster performance in linking the country

wirelessly, with only one city making DiscoveryTech’s

“Top 10 Wireless Cities.” The list was compiled by sur-

veying attendees at the 2008 International Summit for

Community Wireless Networks.

As more funding continues to encourage smart grid

build out, competition for the communications aspect

of these projects will increase. Major defense contrac-

tors are leveraging their experience in setting up secure

military communications to provide similar services for

domestic utilities. Last summer, for example, Southern

California Edison named Boeing a “security partner”

on a $62 million project to connect a 32 MW energy

storage facility to the grid. Lockheed Martin, too, is

involved with eight utilities positioning themselves for

DOE funds. In particular, they are chasing a $150 mil-

lion project proposed by AEP and a $38 million pilot

project by PPL Electric Utilities in Harrisburg, Pa.

20

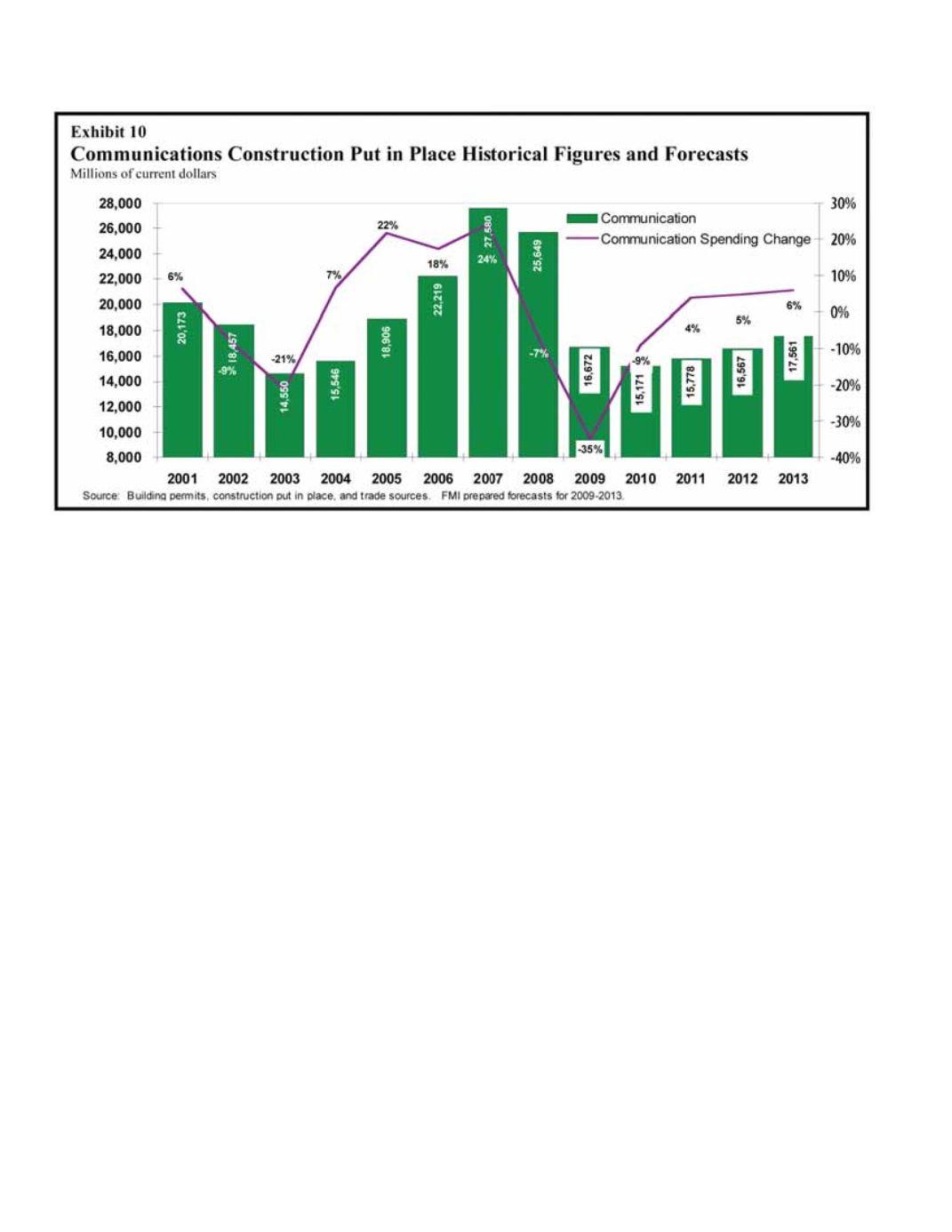

Two firms sure to make headlines for their ambitious

infrastructure upgrades in 2010 are Verizon and Clear-

wire. This year Verizon will complete the first phase

of its massive system upgrade to FiOS, and Broad-

bandDSLReports.comsaid there may be a delay before

the next phase of construction begins. Karl Bode, a

frequent writer and blogger on broadband topics,

explained, “We’re seeing every indication that Verizon

wants to pause and try to ramp up subscriber uptake

in the areas they’ve deployed to before building out

further.”

21

Over the past five years Verizon has invested more

than $17 billion in its communications grid. The

mobile WiMax firm Clearwire LLC may be even more

ambitious than Verizon in 2010, with the goal of 120

million users by year end. This will require quadru-

pling its current footprint. Clearwire CTO John Saw

said, “We just raised another $2.8 billion, and I’m go-

ing to spend all of it.”

22

Conclusion

Your view of the power and communication construc-

tion market depends on two characteristics: where

you sit geographically and your ability to understand

what energy asset owners and operators and cable and

telecom system operators will need. Economic condi-

tions are improving and financial constraints are eas-

ing, but the uncertainty of governmental influence is

raising the risks and challenges in this market. Owners

of energy and communications infrastructure will tend

to be more conservative and focused in their spending

habits over the next two years, while designers and

contractors will need to have clarity about the direc-

tion, velocity, and behavior of the markets they serve.

One size will not fit all in the power and communica-

tion markets over the next two to three years, and FMI

encourages firms to take the time to understand the

dynamics of governmental oversight and regulation,

funding availability, and economic demand factors on

the markets they serve.

Unlike many private companies, utility, cable, and

telecom owners have long been guided by govern-

Market Forecast

Continued from page 16

Continued on page 20