PCCA Journal|3

rd

Quarter 2014

47

Cables Customers:

Broadband Overtaking Video

V

alue propositions for

cable providers are

changing as broadband

becomes more indispens-

able than TV, Moody’s

Investors Service said in a new report,

“Couch Potatoes Are Switching Screens

as High-Speed Data Cable Subscribers

Overtake Video.” Most companies are

well positioned to reap the benefits, and

manage the risks, of the transition.

“Cable providers’ largely upgraded

networks and high-speed capabilities can

make them the first call for consumers

seeking fast Internet connections,” said

Moody’s Vice President - Senior Analyst

Karen Berckmann. “But if cable compa-

nies want to sell their video product as

well, the onus is on them to provide a

compelling video experience at an attrac-

tive price.”

High-speed data subscriber num-

bers will surpass video subscribers for

Moody’s-rated cable companies in the

next year, Berckmann said. Fewer video

customers means lower programming

costs (which are paid on a per sub-

scriber basis), and servicing the video

product tends to be the most challeng-

ing and costly part of the business, so

margins could benefit from the mix shift.

But an eroding subscriber base for

video also poses risks, the report said.

Companies with a dwindling number

of video subscribers lose economies of

scale when it comes to technicians and

customer service, driving up costs per

customer. And a company’s brand may

suffer if it seems to be giving up on

video in favor of broadband.

Companies with significant overlap

with Verizon’s FiOS and AT&T’s uVerse,

such as Cablevision Systems and Time

Warner Cable, will need to invest in a

competitive video product to survive,

Moody’s said, while those with a less

intense competitive footprint will find it

easier to thrive as primarily broadband

companies. An operator that loses a

customer to FiOS or uVerse is likely to

lose that customer entirely, whereas one

losing a customer to Dish Network or Di-

recTV could still maintain a broadband

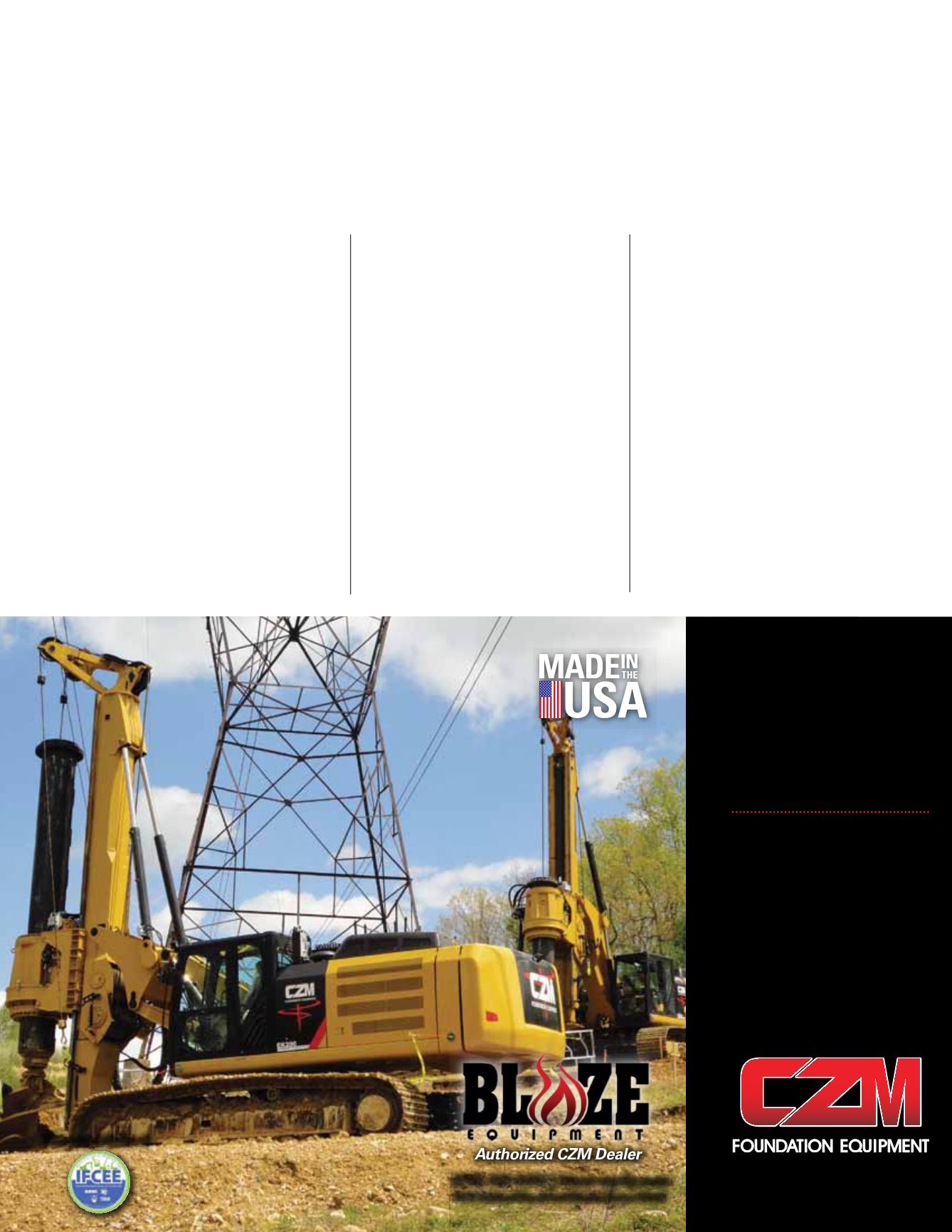

EK200

SHORT MAST

TECHNICAL SPECIFICATIONS

Base ........................CAT C9.3 Acert Tier IV

Drilling Depth........................................ 90 ft

Drilling Diameter .......................132 inches

Maximum Torque ...................163,500 lbf.ft

Main Winch.................................. 48,650 lbf

Working Height..................................... 36 ft

Transport Weight...................... 112,000 lbs

Minimum Transport Weight..... 107,000 lb.

(912) 200-76

141 East Industrial Blvd

Pembroke, GA 31321

(817) 439-0453

5500 NafexWay

|

FortWorth,Texas 76131

Please visit us at

®

Continued on page 48