PCCA Journal|4

th

Quarter 2013

17

remained flat or even declined. This trend is

unlikely to continue, meaning that future ex-

pansions will require additional monies from

ratepayers. Current accelerated infrastructure

replacement programs won’t be threatened,

but future programs are likely to be less

robust in scope and scale. We are ultimately

very bullish on the pipeline space over the next 20 years and

anticipate three waves of capital construction spending and

pipeline replacement. The first wave is coming to an end,

after which we anticipate the industry taking a “breather”

and preparing for a second wave of five

to nine years of spending growth.

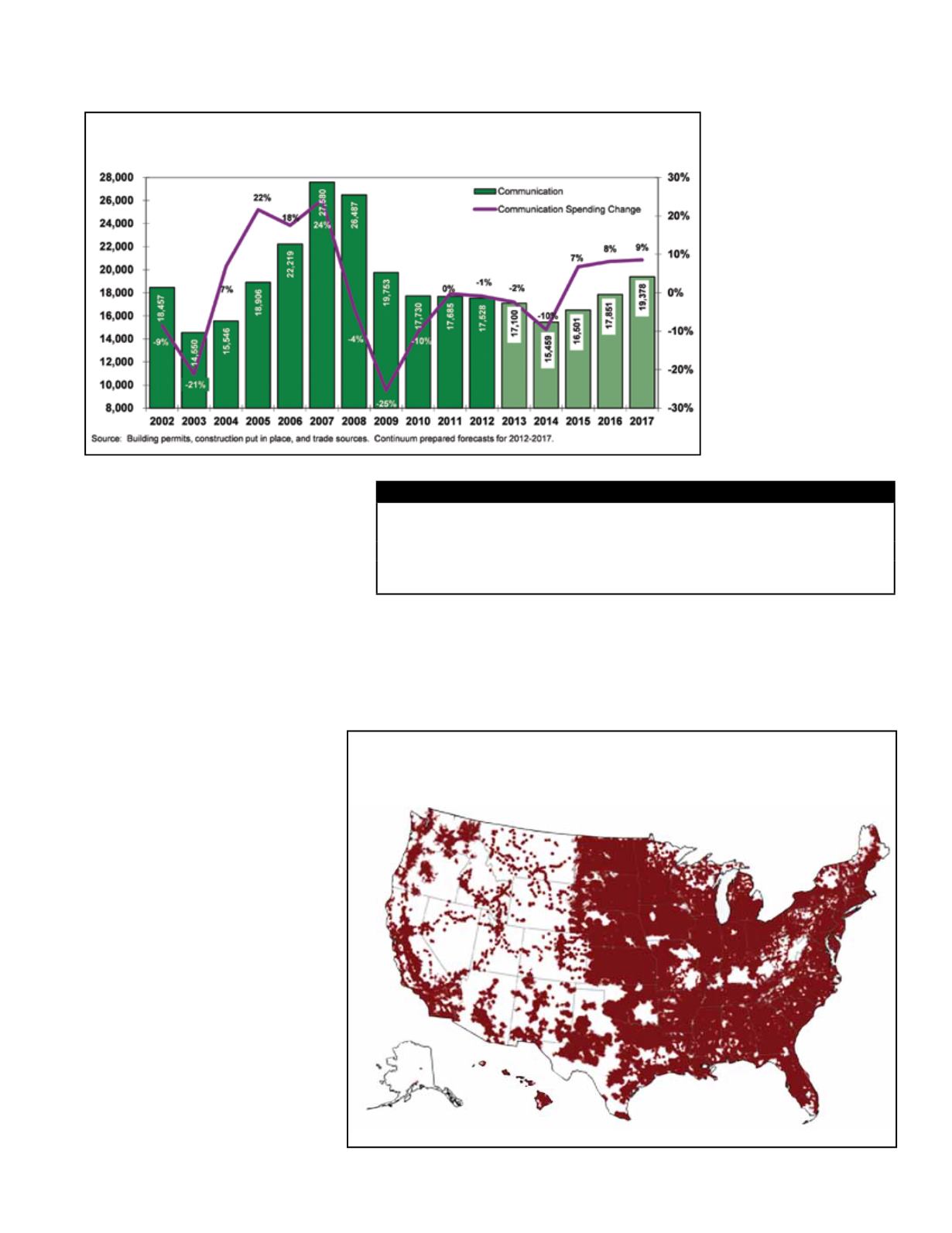

Communication

Spending Forecast

The last peak in communications spend-

ing was 2007/2008 with only modest

recovery. The underlying demand for

data centers and wireless to wired

bandwidth expansion has continued to

support construction spending, but the

current wave of spending, particularly

around 4G infrastructure, is concluding.

Nationally, we forecast little improve-

ment in overall construction spending

until 2015/2016 (Exhibit 7).

The absence of any new revolutionary

technology, particularly in the mobile

network space, results in spending

growth driven by incremental

capacity improvements.

Communication

Abundance vs. Scarcity

Within the communication

construction segment, there

are areas of abundance in

juxtaposition versus scarcity.

The abundance of spend-

ing and rapid rollout of 4G

LTE networks is supporting

construction service provid-

ers operating in the wireless

space. Unfortunately, this

phase of the wireless revolu-

tion is coming to an end.

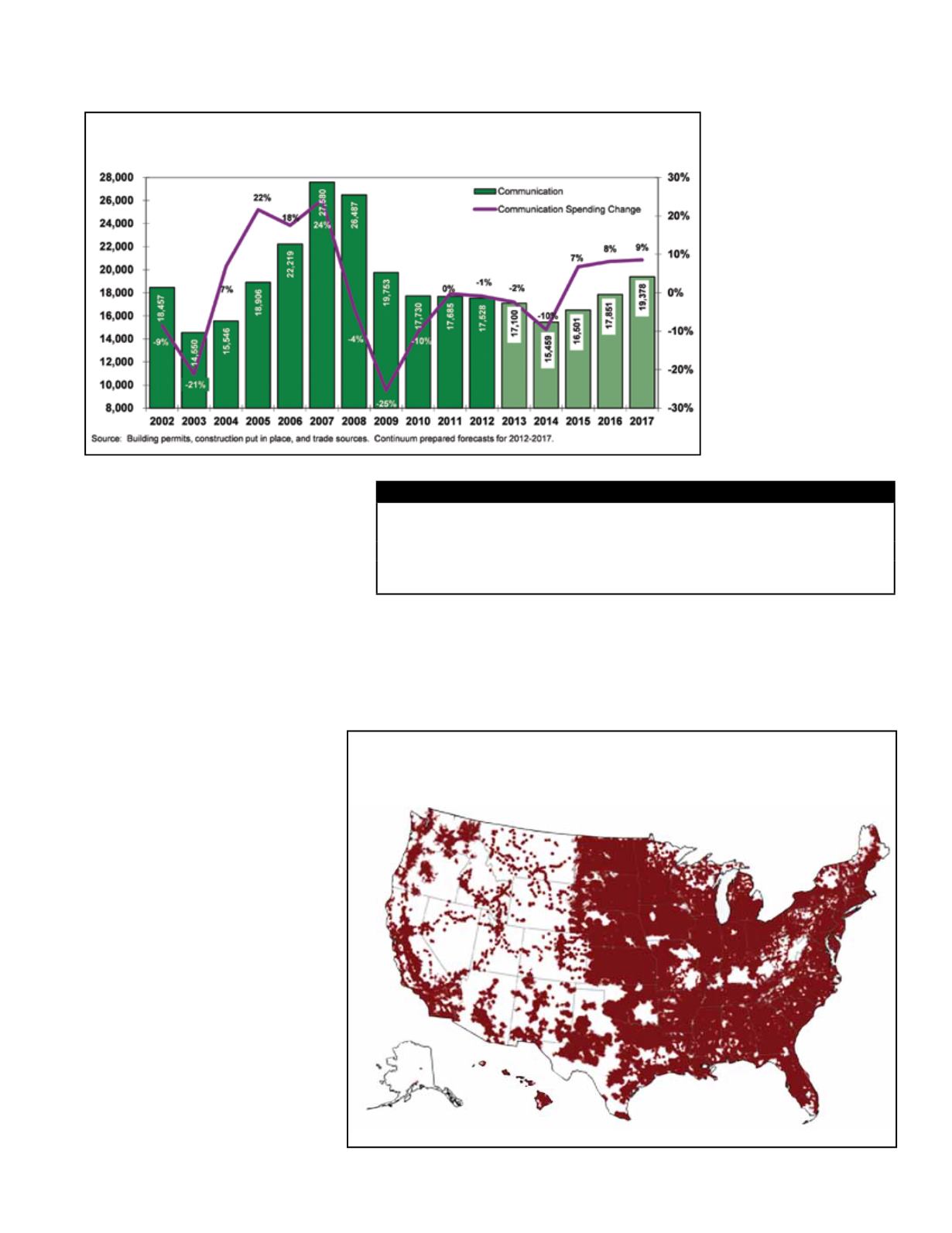

• Verizon’s rollout is essentially complete with 4G now cov-

ering 99 percent of its legacy 3G footprint.

11

• AT&T will complete its initial 4G efforts in late 2014,

Continued on page 18

Exhibit 7

Communications Construction Put in Place Historical Figures and Forecasts

Millions of current dollars

Abundance

Scarcity

• Proliferation of smart devices

• Clarity on technology and nature of 5G wave

• Data bandwidth demand

• Qualified construction technician and supervisory talent

• Rapid rollout of 4G technology

• Government and regulatory support

• Ability to apply telecom workforce into other utility

segments

• National or common operator qualification

requirements

Exhibit 8

Verizon 4G LTE coverage as of 10/30/13