PCCA Journal|4

th

Quarter 2013

15

this sector, moving from approximately $20 billion in 2004 to

$80 billion in 2017. A combination of rising interest rates and

wage pressures will yield inflation that will slow spending as

the first wave of large programs and projects near completion

and ratepayer/PUC fatigue limits the size and scope of new

programs.

T&D Abundance vs. Scarcity

The disparity between abundance

and scarcity is the difference be-

tween the gas and electric markets.

The positive economic and safety

aspects of natural gas exploration,

production, gathering, and T&D are

so powerful as to drive construction

activity in both the pipeline and elec-

tric line sector. On the electric side,

the lower cost to produce power by

burning natural gas yields savings to

electric utility customers and creates

some breathing room for growth in

electric T&D construction activity.

Hurdles still exist.

Labor scarcity, particularly for

the capital construction and O&M

workforce within gas and electric

utilities, will prove a high hurdle.

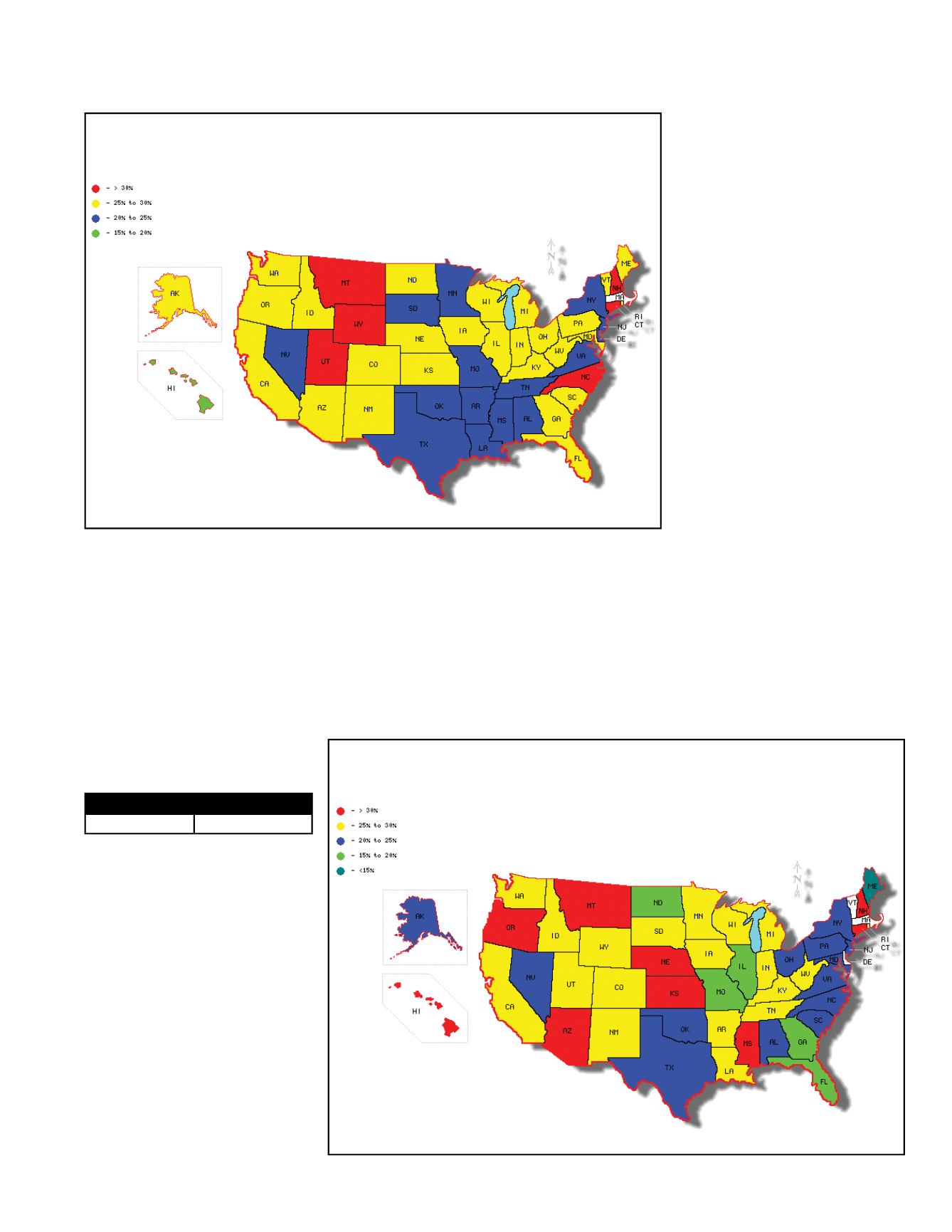

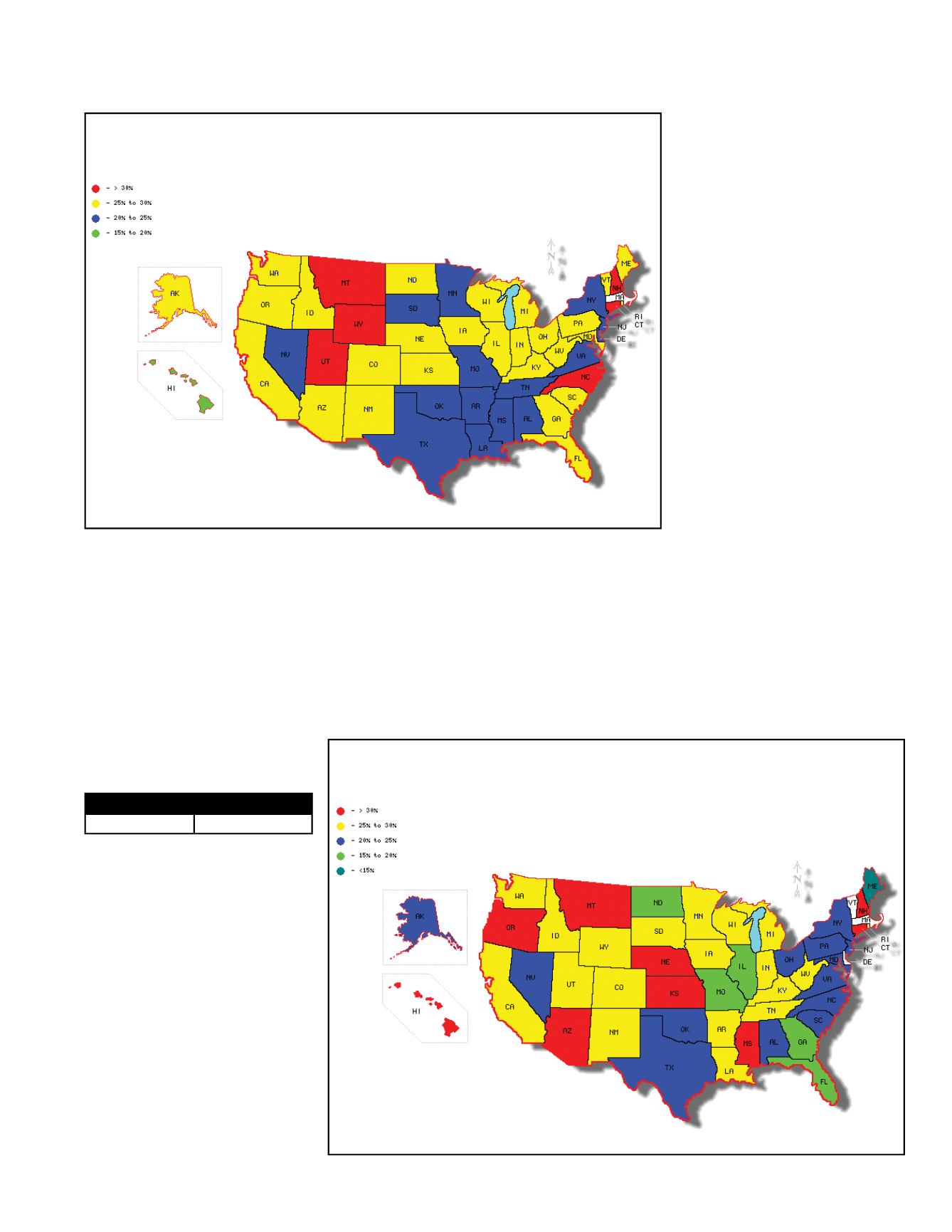

Twenty-four percent and 25 percent

of the electric T&D (Exhibit 3) and

gas T&D workforce (Exhibit 4)

respectively are over the age of 55.

Most of the Northern U.S. states

have a particularly old workforce.

6

Normally we would expect the next

generation, those currently 35 to 50

years old, to be stepping in to fill

the roles of the current baby boom

generation as they retire. Unfortu-

nately this next generation is some

4 million individuals smaller. In

addition, participation in the work-

force is falling. The 2008 recession

had a major effect on the labor

force participation rate, though this

only accelerated a trend rooted in

demographics. The participation

rate will not recover to previous levels regardless of economic

performance

7

(Exhibit 5). For perspective, if the participa-

tion rate was today what it was in 2003, there would be an

additional 5 million individuals in the workforce. Overcoming

this coming labor scarcity will require attracting the younger

generation, 20 to 35 year olds, as well as learning to do more

with less labor and management.

Continued on page 16

Exhibit 3

Electric T&DWorkforce over age 55 by State

Percent ofTotalWorkforce (No data for Mass.)

Exhibit 4

Gas T&DWorkforce over age 55 by State

Percent ofTotalWorkforce (No data for Del., Mass. &Vt.)

Abundance

Scarcity

• Gas-related activity • Electric-related activity