PCCA Journal|4

th

Quarter 2013

14

authorized spending its $100

million contingency fund within

seven days of the flooding, as did

several local utilities. Northern

Colorado must overcome the

challenge of scarcity, be it money,

labor, equipment, or other factors

in order to rebuild.

5

These events serve as an ex-

ample of the situation facing the

utility industry. There is a flood

of work to be completed while

resources of all types are scarce.

Said another way, there is “Water,

water, everywhere, Nor any

drop to drink.” The 2014 Utility

Outlook investigates the spend-

ing, scarcity, and opportunity

in electric and gas transmission and distribution and com-

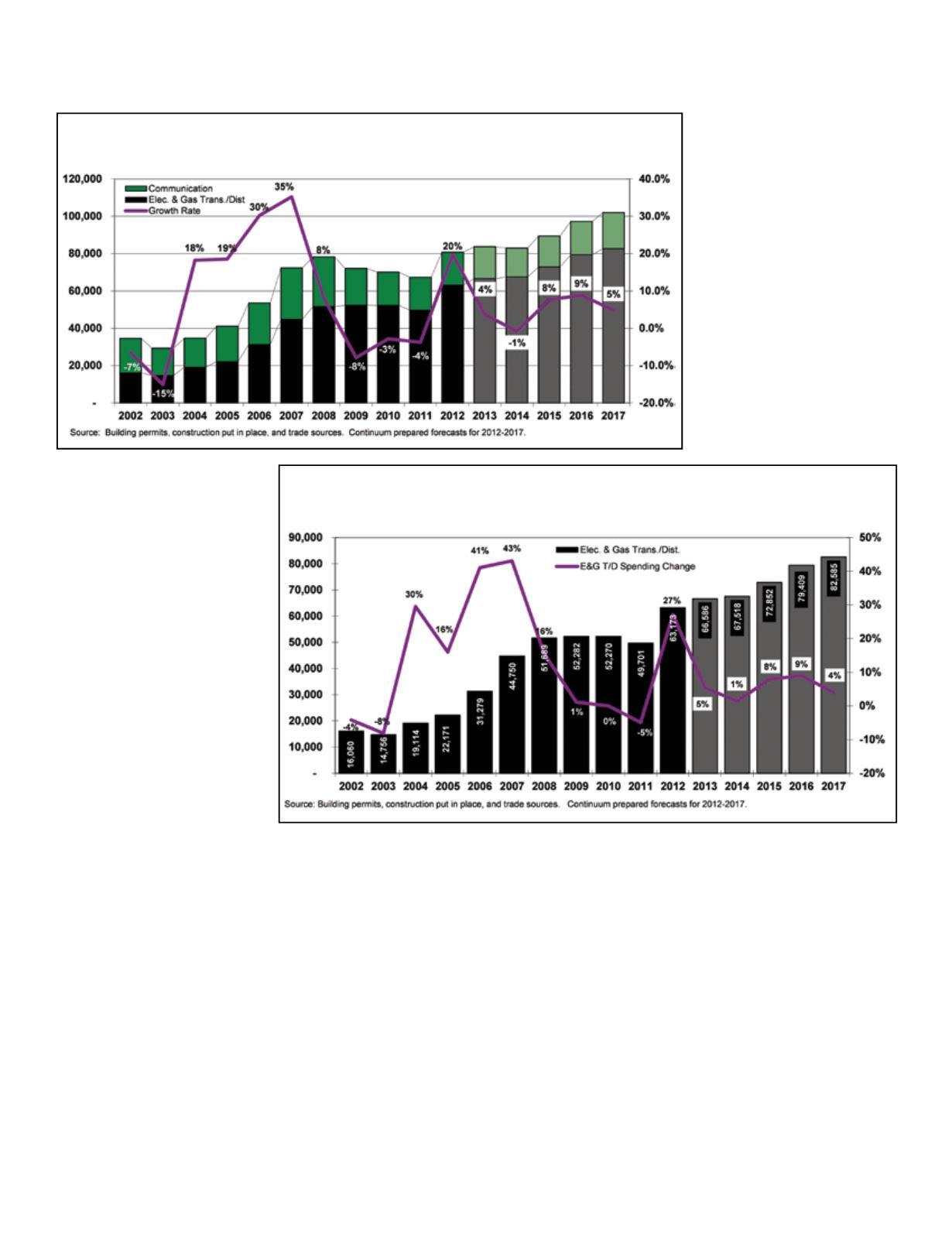

munication sectors. In Exhibit 1, forecasted growth for these

segments is flat or slightly falling in 2014 with growth beyond

that point. Picking the right geographies, market segments,

customers, and services will prove critical. Successful con-

tractors will recognize that this situation demands innovative

solutions to thrive in an environment of scarcity and they

will “Rocket to Success.”

Transmission &

Distribution - Electric and Gas

Spending Forecast

The transmission & distribution (T&D) segment in total

weathered the financial

crisis relatively unscathed

supported by strong spend-

ing on gas and liquid pipe-

lines. The electric sector is

not as healthy. The last two

years have seen rapid pipe-

line spending growth fueled

by economic, government,

tax, and interest rate incen-

tives that overpowered the

underlying slow economic

growth obstacles. In addi-

tion, low natural gas prices

have allowed gas distribu-

tion utilities to undertake

large infrastructure replacement projects with users seeing

very little effect on their bills. Gas prices have bottomed and

will slowly rise, changing this dynamic.

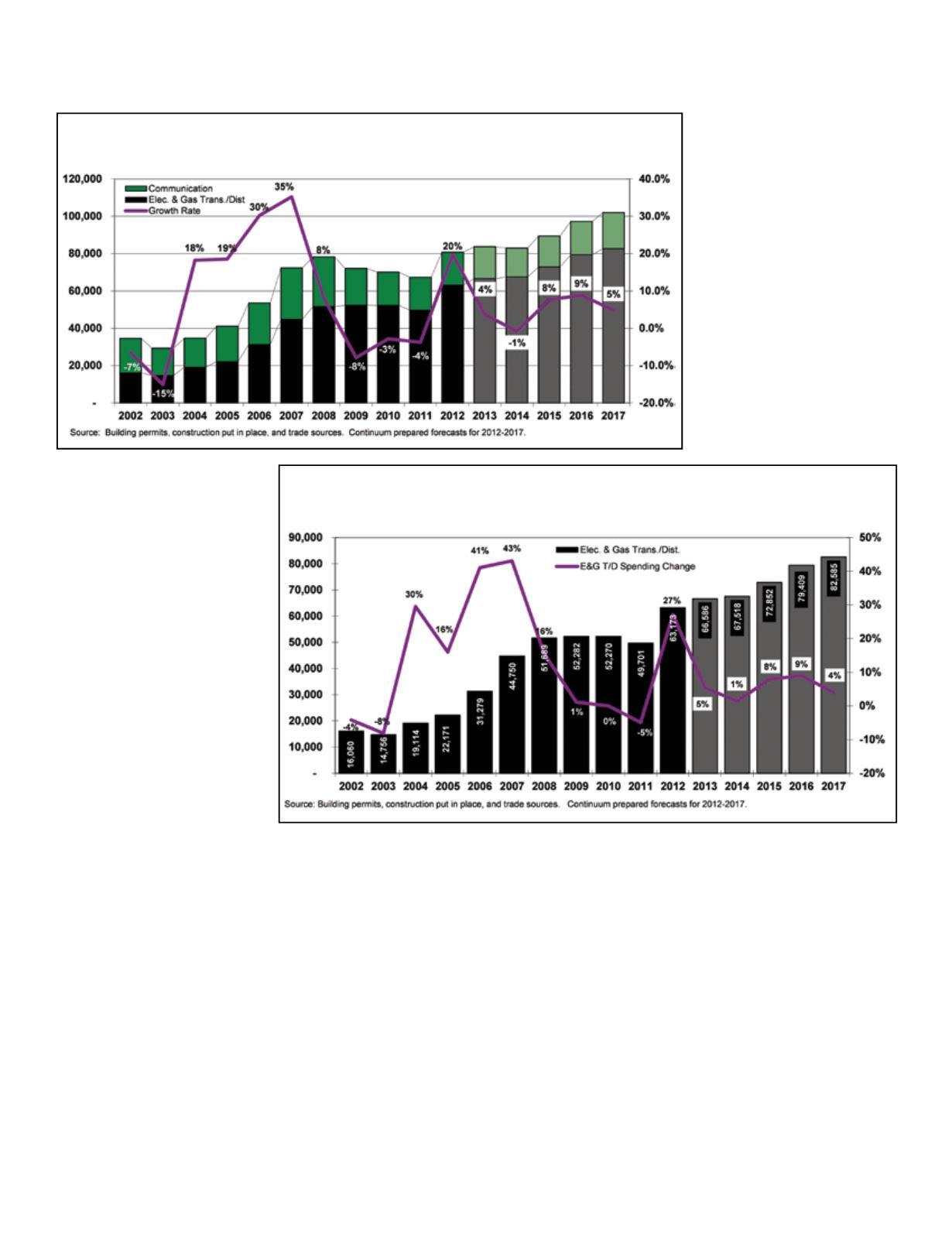

Moving forward, a slowing of the growth rate from 2012

and 2013 is forecast (Exhibit 2). A brief and shallow eco-

nomic slowdown is forecasted in late 2014 or early 2015, as

is weak electric power demand, increasing utility bills, and

the slow rise in natural gas prices. All of that will combine to

temper the enthusiasm for additional infrastructure replace-

ment projects. By 2016, an improving economy and housing

market and a gradual increase in electricity demand will ac-

celerate spending on both pipelines and electric lines. Growth

is forecast to slow in 2017, by which point we will have

experienced more than a decade of spending growth within

Rocketing to Success

Continued from page 13

Exhibit 1

Electric/Gas T&D and Telecom Construction Put in Place Historical Figures and Forecasts

Millions of current dollars

Exhibit 2

Electric/Gas T&D Construction Put in Place Historical Figures and Forecasts

Millions of current dollars