PCCA Journal|2

nd

Quarter 2014

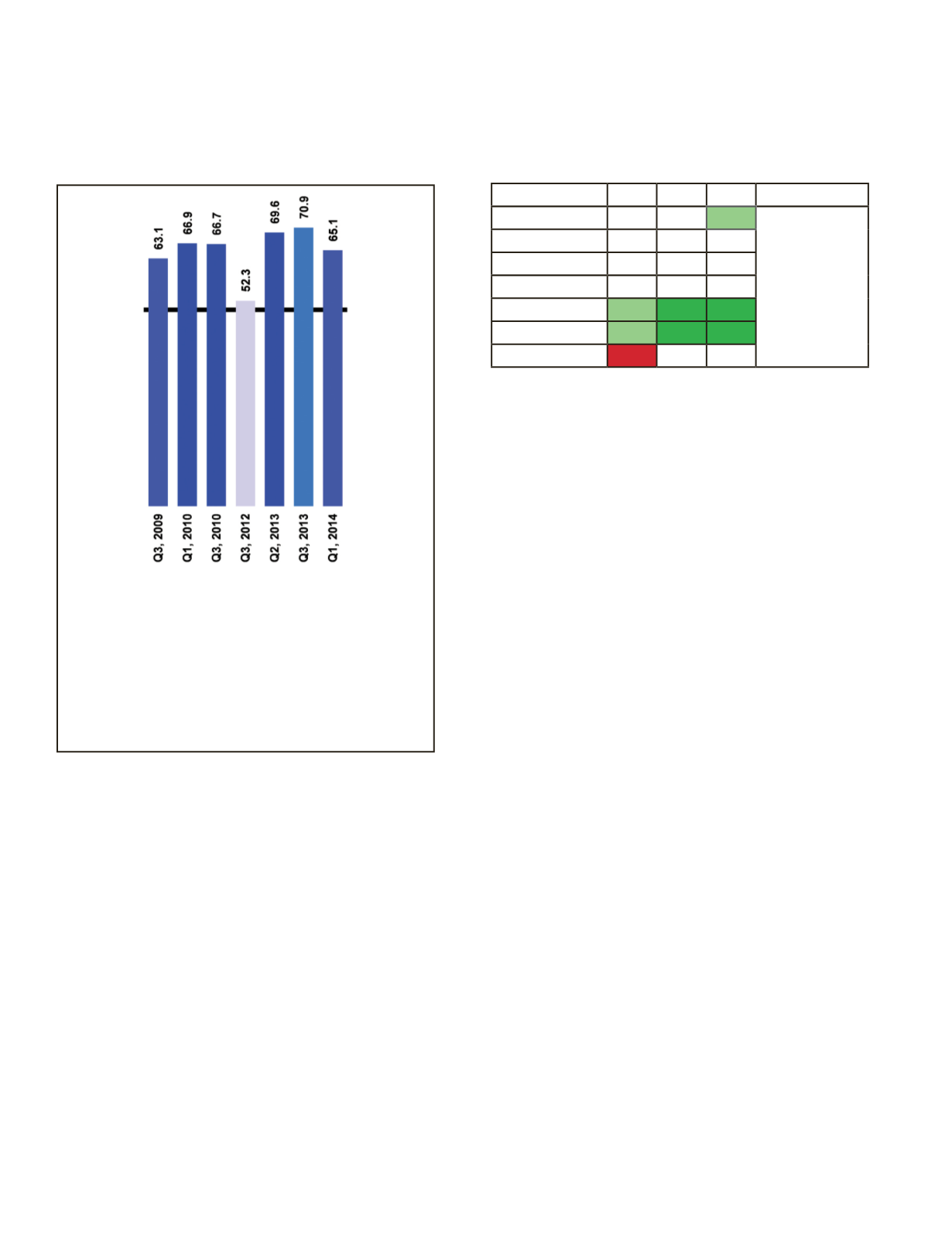

16

troughs in perspective and optimism occurred prior to 3rd

Quarter 2009 and in 3rd Quarter 2012. Since 2012, the level of

optimism about the utility market and specifically the pipe-

line market has continued to exhibit both positive perspective

and very high optimism, with index figures well above 50.0

(Exhibit 4).

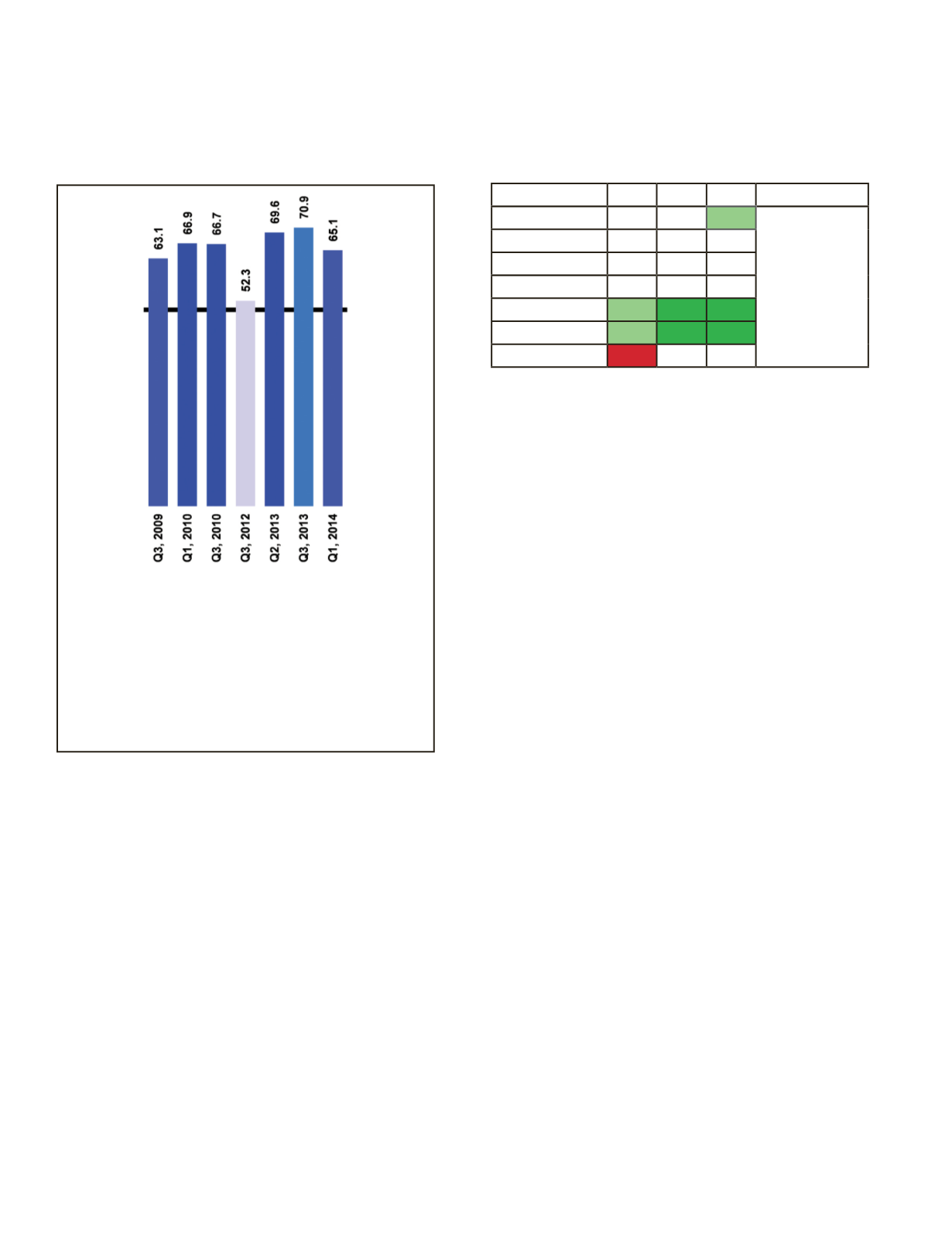

Among the various utility construction sectors, gas trans-

mission and distribution exhibit the highest optimism over

3-month, 1-year, and 3-year timelines, and electric distribu-

tion is viewed optimistically in a 3-year timeline (Exhibit 5).

Index scores above 50 indicate an improving market and level

of optimism. An index score of 100 is the maximum on the

scale, and these sectors exhibit scores of 80 or higher and far

exceed the level of optimism in any of the other segments.

Only the sewer sector falls below the 50 range, indicating

that this market is perceived as shrinking and defined by

pessimism. All other sectors are demonstrating varying levels

of optimism. Among the more moderate optimism sectors are

telecom and electric T&D where optimism is rising over the

next 3 years into ratings in the 70 range.

Scarcity and Constraint

The optimism in this sector is only tempered by scarcity that

is faced. The utility market sector is already experiencing

scarcity. Looking forward, these challenges will continue to

the point where only the most progressive and forward-think-

ing contractors will thrive.

Challenges to be faced include:

• Labor:

Low birth

rates, aging popu-

lation, and lower

workforce participa-

tion rate.

1

• Utility Internal

Workforce Older than 55

: 40 percent of inspectors, 25

percent of surveying and mapping specialists, 25 percent

of operating engineers, 25 percent petroleum engineers, 25

percent frontline supervisors.

2

• User Rate Increases:

Ratepayer and PUC fatigue due to

rates rising faster than inflation since 2005.

3

• Technology Innovation:

The pace of change in the con-

struction industry is glacial and must accelerate.

The obvious reaction to scarcity is to see challenges as

opposed to promise and opportunity. We believe successful

firms will embrace the growth and potential scarcity in these

markets for what they are—promise and opportunity.

Conclusion

“No matter how I try, I find my way into the same old jam.”

Don’t get caught in the same old jam; instead, embrace this

utility construction environment as one filled with the prom-

ise and opportunity. We offer three critical strategies to help

Exhibit 5

UCI Utility Index Detailed Results by Market Sector

1st Quarter 2014

Business Outlook

3 month 1 year

3 year

Interpretation

Electric Distribution

73.4

72.5

81.5

In nearly all cases, the

markets are perceived

as positive and

improving at a faster

rate over the 1 and 3

year timelines.

Electric Transmission

66.7

63.9

74.3

Telecom

65.3

71.9

71.0

Gas/Liquid Distribution 85.3

91.5

93.1

Gas/Liquid Transmission 85.9

92.7

92.4

Water

55.9

64.1

75.0

Sewer

48.6

57.9

66.2

“Our general outlook is positive with

expanding growth prospects.”

– Large National Pipeline Contractor

Exhibit 4

Historic Summary Utility Construction Index

3

rd

Quarter 2009 to 1

st

Quarter 2014

Interpretive Note:

A diffusion index is designed to establish whether

participants perceive a positive and optimistic business environment versus

a negative or pessimistic one. A reading above 50.0 indicates improving or

expansion, a rating at 50.0 indicates remaining the same, and below 50.0

indicates worse or contracting. Therefore, if a reading goes from 30.0 to 40.0,

then the result still implies a decline from the previous quarter because 40.0 is

below 50.0, but the decline is slowing because 40.0 is above 30.0. As another

example, if the diffusion index changes from 35.0 to 70.0, it implies a change

in direction and improvement over the previous quarter, not because 70.0 is

above 35.0, but because 70.0 is above 50.0.

Good Times, Bad Times

Continued from page 14