PCCA Journal|2

nd

Quarter 2014

13

T

he overhead and underground utility construc-

tion market and particularly the distribution

and transmission pipeline construction mar-

kets are exceptionally healthy, and the overall

mood and perspective of contractors is one of

great optimism.

Executive Summary

In the immortal words of Led Zeppelin, the overall utility

construction market has seen both good and bad times. The

current market is perhaps the best in 60 years, and many util-

ity contractors are expressing their optimism that this market

will continue for some time. The optimism is particularly

strong in the distribution and transmission pipeline construc-

tion markets, which are exceptionally healthy, while electric

distribution is also expected to yield growth. Water and sewer

are least attractive, and telecom, while positive, is not as

robust as other markets. As a side note, Continuum is more

bullish in the 2- to 4-year prospects of the telecom market.

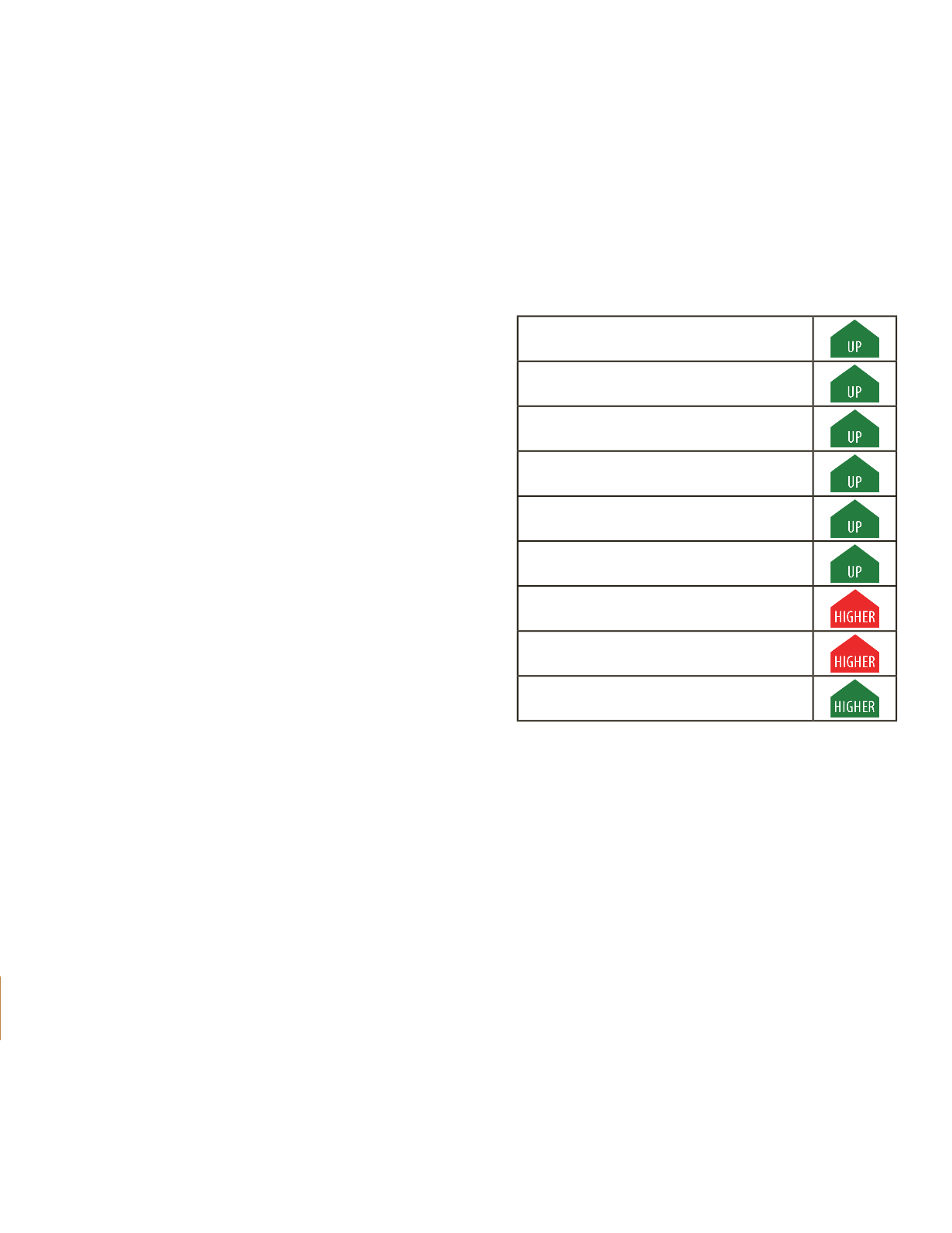

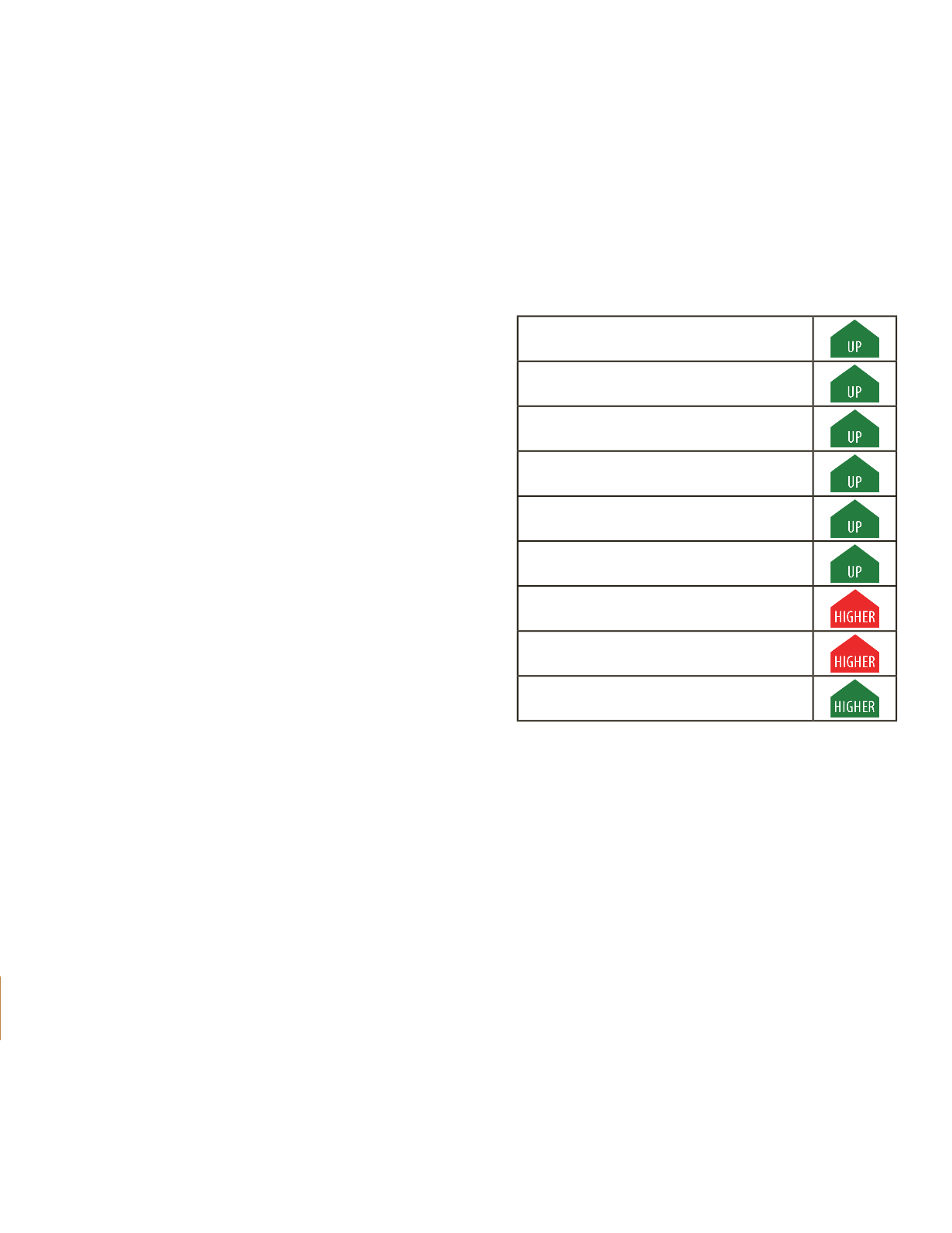

Utility Construction Index

Periodically, Continuum Advisory Group tests utility con-

struction firm perspectives to develop a Utility Construction

Index (UCI). This index is designed to test perspectives of

infrastructure and utility construction industry firms and

establish the degree of optimism or pessimism prevalent. The

index is made up of a confidence level, backlog projections,

cost and productivity factors, and business outlook for all of

the utility sectors, including electric power T&D, telecom, gas

and liquid T&D, and water and sewer. Nine factors feed into

the summary and were tested through three recent nation-

wide surveys of utility contractors. The results demonstrate

seven factors as optimistic, and improving and two factors

rated as pessimistic or worsening

(Exhibit 1).

Of greatest optimism are expected

improvements in backlog, continued

improvements in their firm’s perfor-

mance, and continued improvement in

the utility construction markets where they do business. The

least optimistic area is the overall economy, where the level

of optimism has fallen since 3rd quarter 2013. The concerns

that have slowed the level of optimism revolve around federal

monetary policy, deficit spending, the national debt, execu-

tive branch leadership, and a dysfunctional Congress. Expec-

tations of rising costs in construction materials and labor are

the two factors where pessimism rules.

Historic Perspective

Perspectives on the utility markets have moved up and

down dramatically since the financial and economic crisis in

2008/2009. Utility construction spend-

ing has performed better than any other

type of construction, exhibiting the

smallest amount of shrinking in 2009,

2010, and 2011. The electric and gas

sectors performed the absolute best,

exhibiting steady spending from 2008 through 2010 and only

very modest shrinking in 2011. Growth has and will continue

“Good Times, Bad Times,

You Know I’ve Had My Share...”

Mark Bridgers and Nate Scott

Overall Economy

Overall Economy WhereWe Do Business

Our Construction Business

Residential Building

Construction Market WhereWe Do Business

Utility Construction Market WhereWe Do Business

Our Expected Backlog

Cost of Construction Materials

Cost of Labor

Productivity

Exhibit 1

Utility Construction Index Summary

1st Quarter 2014

“[We are] very bullish about our business

[and see] lots of opportunity out there.”

– Overhead/Underground Utility Contractor

Continued on page 14