This is a SEO version of PCCAJournal2ndQuarter2011. Click here to view full version

« Previous Page Table of Contents Next Page »PCCA Journal|2 nd Quarter 2011 17

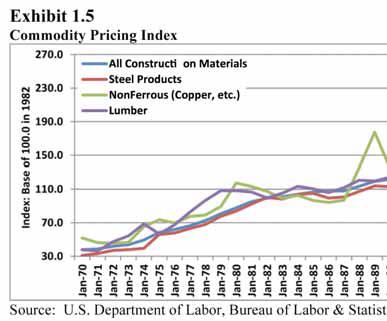

Commodity Price Increases

The quantitative easing policy will have an immediate effect on the cost of con-struction commodities. Oil, copper, and lumber are three examples that began increasing in cost during 2010 and have accelerated since November in part due to the change and anticipated change in the value of the dollar. The Economist on January 15 pondered, “Given that the global recovery is at a very early stage, do high prices indicate that the world faces significant supply constraints... for years to come...prolonged inflation... tighten[ing] monetary policy...specula-tive activity in the futures market?” 5 Changes in commodity, material, and equipment costs will obviously impact construction budgets. In the vast major-ity of cases, utility and industrial owners constructing capital assets over the previous two years have observed sav-ings on construction spending primarily related to lower commodity, materials, and equipment costs rather than some-what lower labor or construction labor costs. In Exhibit 1.5, the drop in lumber prices beginning in 2006 and the drop in steel and non-ferrous metal (copper,

etc.) pricing since 2008 is obvious. Not shown in the chart, the high point of pricing for steel, nonferrous metal, and lumber after 2006 to the low point that occurred in 2009 or 2010 is in excess of 40 percent, 60 percent, and 30 percent reduction respectively. “Higher pricing may cause a surge in head line inflation but their main effect will be to act as a tax on consumers” 6 of these commodi-ties. Industrial and utility owners, and the contractors that work for them, are among the biggest consumers of con-struction commodities. Benefits accrued over the previous two to four years will be eroded through this “tax” over the coming 24 to 36 months through rising commodity prices. These owners are unlikely to succeed in simply pushing all of this risk onto the contractors or ven-dor community while commodity prices are likely to be both highly variable and rising over the coming 24 to 36 months. Both lumber and non-ferrous metals are already experiencing increased pricing that is anticipated to accelerate. Actual results since December 2010 have shown just this type of acceleration, with steel and non-ferrous metal particularly exhib-iting rapid increases.

Conclusions

The old quip “a stitch in time saves nine” offers some insight into the win-dow of opportunity facing U.S. utility contractors as they plan for and mitigate three risks:

• U.S. inflation

• Devaluation of the U.S. Dollar

• Commodity price increases With these certainties are a host of relative uncertainties associated with the policy of quantitative easing. Utility contractors will be forced to navigate these challenges and search for real op-portunities to eliminate or mitigate the risks faced.

Four initial recommendations are ap-propriate for nearly every utility contrac-tor to begin the process of mitigating the risks faced and creating accessible opportunities.

• Hedging: Mitigate downside risk in fuel, interest rates, and commodity materials.

◆ Fuel, interest rates, and under cer-tain conditions commodity materi-als offer multiple opportunities to mitigate both price increases and variability.

Continued on page 18

This is a SEO version of PCCAJournal2ndQuarter2011. Click here to view full version

« Previous Page Table of Contents Next Page »