This is a SEO version of PCCAJournal2ndQuarter2011. Click here to view full version

« Previous Page Table of Contents Next Page »PCCA Journal|2 nd Quarter 2011 16

Quantitative Easing

Continued from page 14

that are likely to cause inflation currently exist, and if they are not unwound in the next 12 to 36 months, the U.S. will enter a period of higher inflation. In point of fact, the quantitative easing policy is in-tended to create inflationary pressure to stave off the threat of economic stagna-tion, defined as a very low growth rate of 1 percent or less. Policymakers at the Federal Reserve currently fear stagnation to a greater degree than they see future inflation as problematic.

Two examples of inflationary expecta-tions can easily be found. First, a recent auction of inflation-adjusted securities sold at an anticipated negative return. This negative return is an overpayment for the face value of the security, like buying a $10 bill for $11. The buyers of these securities anticipate that the inflation adjustment mechanism of these bonds will be utilized in the future and result in higher interest payments. Es-sentially, investors expect to earn the negative return back with these higher interest payments over time. If inflation at higher rates does not come to pass, investors will simply have paid too much for these bonds, again like buying a $10 bill for $11.

“The Treasury sold $10 billion of five-year Treasury Inflation Protected Securi-ties at a negative yield for the first time at a U.S. debt auction as investors bet the Federal Reserve will be successful in sparking inflation.” [Footnote 3 ] The second is the credit-default swap market where activity volumes have spiked since November of 2010. “Plenty of investors are concerned about the potential impact of the Federal Reserve’s monetary policies and inflationary pres-sures on Treasury bond yields. Treasury-related default swap contracts worth nearly $1.4 billion changed hands in the two weeks ended January 21, 2011, according to the Depository Trust and Clearing Corporation—two-and-a-half times the average activity over the previ-ous six months. The surge in activity points to an intensifying investor percep-tion that the possibility of government default can no longer be completely dismissed.” 4 The likelihood of U.S. default on existing debt is exceptionally remote, but the increase in trading activ-ity in instruments that hedge against a potential default speaks to the shifting perceptions of the creditworthiness of the U.S. government.

U.S. Dollar Devaluation

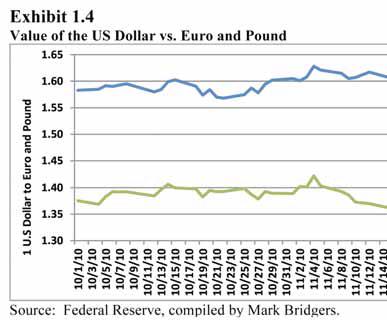

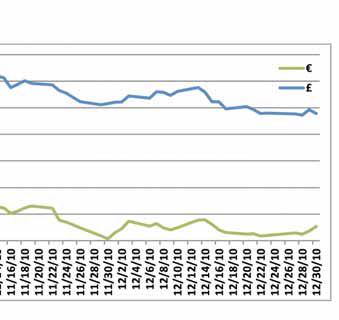

Transactions or purchases denominated in dollars for goods or services created outside of the U.S. will result in the mak-ers of these goods or services demanding more dollars for their efforts as the value of the dollar will fall in relative terms to their home currency. Exhibit 1.4 displays the value of the U.S. dollar as measured in Euros, and since the implementation of the quantitative easing policy took place on November 3, 2010, the U.S. currency has lost value in comparison to the Euro. The British Pound Sterling has followed a similar trajectory. Closer to home, the Brazilian Real and Canadian Dollar are also appreciating against the dollar, eroding the purchasing power of the U.S. currency. Since December 2010, the pace of appreciation has accelerated for each of these currencies. Overall, devalua-tion of the dollar makes U.S. exports more cost competitive and attractive as well as making imports to the U.S. more expensive. Many construction commodi-ties, particularly lumber, copper, oil, and petrochemical products, are imported or internationally sourced through transac-tions denominated in dollars.

This is a SEO version of PCCAJournal2ndQuarter2011. Click here to view full version

« Previous Page Table of Contents Next Page »