This is a SEO version of PCCAJournal2ndQuarter2011. Click here to view full version

« Previous Page Table of Contents Next Page »PCCA Journal|2 nd Quarter 2011 12

rower and lender. This explains in part why some fall in longer-term rates has occurred but they are still within historic ranges, particularly for long-term trea-sury and corporate bonds.

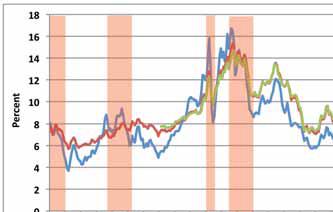

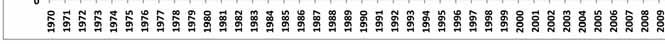

Exhibit 1.2 presents the coupon rates for 1yr, 10yr, and 30yr treasury bonds over the past 40 years. Both 10yr and 30yr bonds are at the low end of their historic range, while 1yr treasury bills are at unprecedented low rates. Since

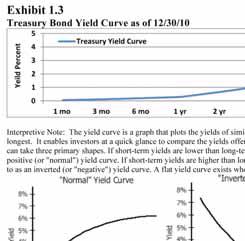

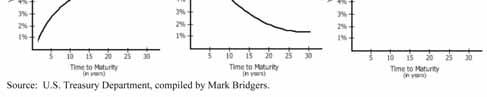

December, the rates on the 10yr and 30yr instruments have trended slightly up rather than down. Another way to look at how investors are anticipating market risks to rise or fall is to prepare a yield curve comparison. Exhibit 1.3 depicts the yield curve for treasury bonds as of December 30, 2010, for maturities ranging from 1-month to 30-years. This particular yield curve is classified as a “normal” yield curve reflecting an expec-

tation of increasing risk meriting higher yield or return as the term lengthens. The intervening months since Decem-ber have results in no yield curve shape change.

Quantitative Easing as Alchemy?

Given that there is little more that the Federal Reserve can do with interbank borrowing rates, it has moved to a policy of quantitative easing. The Federal Reserve is going to essentially create the $600 billion necessary to imple-ment this policy either by crediting the accounts of banks and brokerages from which it buys securities or the printing of currency through the treasury. The net effect of either approach is the same, placing more currency into circulation. This is manufactured demand for bonds and an increase in the money sup-ply. The first round of $75 billion was undertaken in November 2010, a second round of the same amount occurred in December 2010, and subsequent monthly expenditures are expected through June 2011. Over this implementation timeline, the intended result is a more

Quantitative Easing

Continued from page 11

Continued on page 14

Exhibit 1.2

1 Year, 10 Year, and 30 Year Bond Coupon Rates

Source: Federal Reserve, compiled by Mark Bridgers

This is a SEO version of PCCAJournal2ndQuarter2011. Click here to view full version

« Previous Page Table of Contents Next Page »