This is a SEO version of PCCAJournal2ndQuarter2011. Click here to view full version

« Previous Page Table of Contents Next Page »PCCA Journal|2 nd Quarter 2011 11

F

earing continued economic stagnation and high unem-ployment, the Federal Re-serve recently announced a policy of “Quantitative Eas-ing” as a panacea for these ills. There is broad diversity of opinion about whether using $600 billion to purchase bonds will work, even among the Federal Reserve System’s Board of Governors. “[Quantitative easing] won’t push inflation to ‘super ordinary’ levels,” said Ben Bernanke, Federal Reserve System Board of Governors Chairman, on No-vember 3, 2010.

“The Federal Reserve is not a repair shop for broken fiscal, trade or regula-tory policies. Given what ails us, addi-tional monetary policy measures are, at best, poor substitutes for more powerful pro-growth policies,” said Kevin Warsh, Federal Reserve System Board of Gover-nors Member, on November 8, 2010. Many utility contractors wonder how this policy will affect their ability to prof-

itably construct a client’s capital assets. What is certain is that inflation in the U.S. will increase, the dollar will depreci-ate in value, and dramatic commodity price increases will take place. Unpre-pared utility contractors will be punished by these environmental changes in 2012 and beyond.

Federal Reserve System

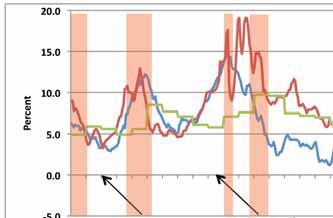

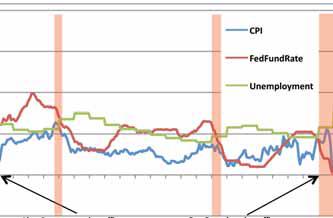

The Federal Reserve controls the inter-bank borrowing or federal funds rate and pushed this rate down to essentially 0 percent. This rate is the cost for reserve system member banks to borrow funds and in theory lend these amounts to individuals and businesses. Exhibit 1.1 displays a 40-year period covering seven recessions and comparing the federal funds rate to one measure of inflation (CPI) and the U.S. unemployment rate. At essentially 0 percent, the federal funds rate is much lower than it has ever been during this 40-year period, and both inflation and unemployment are at

their historical extremes.

A low federal funds rate tradition-ally boosts economic growth, but in this case, it has not sparked a higher growth rate or reduced unemployment. This federal funds rate indirectly affects interest rates that utility contractors pay for financing through lines of credit, debt, or corporate bonds. It is, however, related. When the federal funds rate goes down, the interest rates these firms will pay for various forms of credit can fall. The Federal Reserve effectively steps on the brake or accelerator for the economy with this tool.

Long-Term Credit Markets

Adjustments to the federal funds rate tend to have low impact on the cost of longer-term forms of credit like trea-sury and corporate bonds. The interest rate or cost for these credit instruments are more directly tied to longer-term economic risks faced by both the bor-

Poison or Nourishment?

Why Quantitative Easing Demands That Utility Contractors Hedge Their Risk Today!

By Mark Bridgers

Continued on page 12

Exhibit 1.1

40 Year Comparison of Recessionary Periods to Federal Funds, Inflation (CPI), & Unemployement Rates

Source: U.S. Department of Labor, Federal Reserve, compiled by Mark Bridgers

This is a SEO version of PCCAJournal2ndQuarter2011. Click here to view full version

« Previous Page Table of Contents Next Page »